Opening the aFRR Market in Belgium – A unique and innovative 2 step auction model

When Next Kraftwerke expanded its operations to Belgium in 2014, one of its goals was to convince the transmission grid operator Elia to open its automatic Frequency Restoration Reserve (aFRR) market for all technologies. aFRR, also known as secondary reserve, has historically been provided by a handful of gas fired power plants operated by two or three companies.

It took until 2016 for things to start moving into a new direction, when Elia decided to organize a pilot to investigate the possibility to open the secondary reserve market to aggregators. This pilot was successful and led to the decision to open the Belgian aFRR market in the fall of 2020 with the introduction of a unique two-step auction design. Why did it take so long, and how does the new market design fare in real-world conditions?

Towards open and competitive balancing markets

Regular readers of our blog series should by now be quite familiar with the reserve power markets in Europe. Reserve power products allow transmission system operators (TSOs) to maintain a stable frequency and balanced grid by managing the balance between production and consumption on the public grid. Since TSOs do not possess the assets themselves to maintain and restore that balance, they procure flexibility from market parties. Broadly speaking, most Western European countries have three categories of reserve power products: FCR (Frequency Containment Reserve), aFRR (automated Frequency Restoration Reserve), and mFRR (manual Frequency Restoration Reserve).

It is no different in Belgium. Since the unbundling of the energy system in the beginning of this century, grid operator Elia has relied on market parties to keep the lights on. Not all market parties could provide balancing services, though. In their early days, balancing markets were mostly an extension of the balancing tools of the former vertically integrated energy system - an obligatory service to be offered by large thermal power plants. Yet, in Belgium, there are few such plants. And there are even less companies that own them. The balancing markets were barely worthy of that name.

To increase competition, Elia and the Belgian regulator CREG decided to open the mFRR market in 2013. Elia created the possibility to offer this ‘last resort’ balancing power with facilities on the distribution grid. These could be production assets, like emergency gensets or CHPs, but also consumption assets –referred to as demand response. Since 2017, more than 1100 MW of mFRR power is offered in the market, about 250 MW to 500 MW more than what is usually auctioned by Elia. A sign of a well-supplied market.

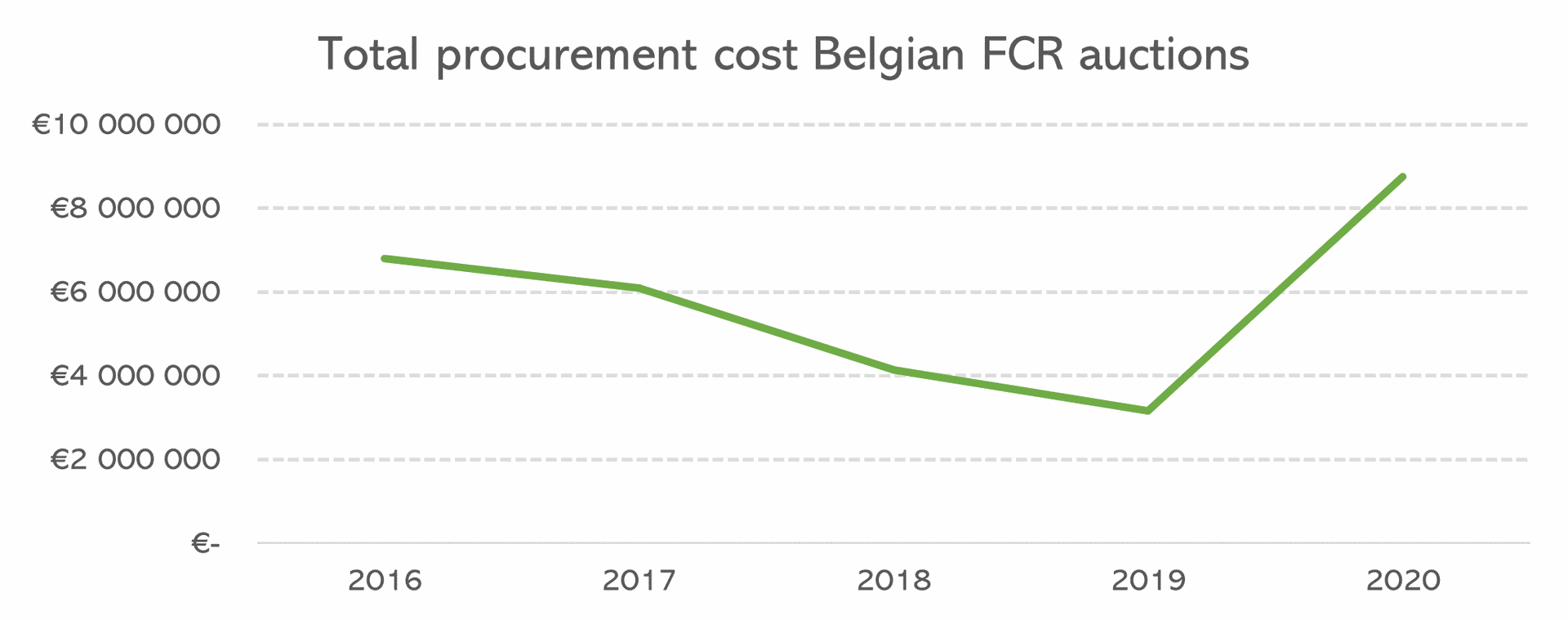

In 2016, it was the FCR market’s turn to be opened. Between 2016 and 2019, average prices in the local FCR auction dropped by more than half. Good news for the end consumer, who foots the bill for balancing services through Elia’s grid tariffs (see illustration below). Since Elia moved the FCR auction to the so-called Common Auction (organized together with neighbouring TSOs) in July 2020, prices have increased again.

The reasons for this sudden increase in FCR prices are twofold. On the one hand, the price drops in the previous years combined with a new and hefty penalty scheme led some of the larger market parties with conventional technologies to leave the market. The remaining Belgian providers are now providing FCR primarily with lithium-ion batteries. On the other hand, the Common Auction bidding rules allow large indivisible bids and oblige Elia to buy 30% of its FCR needs locally.

The reduction of competition between Belgian providers led to an increase in prices. Eventually these high prices will attract new volume, as it always does, and it is reasonable to expect the Belgian FCR prices will drop to levels in line with the rest of the common auction later this year. This roller coaster of prices shows that opening a market does not always guarantee lower balancing costs; it needs to go hand in hand with an adequate market design.

And aFRR? Caution and hesitation prevail

Why did it take another four years before the aFRR product was opened to smaller and decentralized assets? It is quite simple: aFRR is Elia’s most important product to manage day-to-day imbalances in the Belgian grid. Even though as little as 140 MW of aFRR power is sufficient to resolve the usual mismatches between supply and demand, it is the cornerstone to maintain the Belgian grid balance. Opposite to FCR and mFRR, which can be implemented respectively locally (based on a frequency droop setting) and manually (with a simple start and stop trigger), the aFRR product is activated automatically by the SCADA system of Elia. A reliable high-speed data connection between the aFRR provider and Elia is necessary to receive the desired setpoints in real-time.

The aFRR product has always required an accurate response (within a narrow band around the requested power setpoint) and quick response (full power to be developed in 7.5 minutes, setpoint updates every 4 seconds). Historically, only a couple of combined cycle gas plants (CCGTs) were able to meet these high technical standards. The natural result was that the market design became tailor-made for the CCGT-technology.

An example of the characteristics of CCGTs are their high start-up costs. Historically, balancing power was procured on long time horizons of months or weeks. This also suited the CCGTs. The longer the contract period, the more the high start-up costs can be spread out. Shorter bidding periods of 24-hour or even 4-hour blocks, often considered important to enable balancing provision by for example demand response, were not used. Another design feature suited for CCGTs was the allowance to bid symmetrically, to avoid that the start-up costs would be priced in in both the downward and the upward bid.

These market rules were understandable, pragmatic, and beneficial for Elia to avoid unnecessarily high balancing costs. Yet, a tailor-made suit cannot be worn flexibly. The market design made it difficult for other technologies to enter the aFRR market. It therefore cemented the natural oligopoly which arose between the few CCGT operators active in the market. The limited competition was again a risk for the affordability of the product. No wonder that the regulator demanded activation prices to be capped and monitored closely.

This approach had the desired effect: it kept balancing costs in aFRR at bay. But was it really the best solution overall? And what about the uncertain future of many gas plants? Could Elia keep counting on CCGTs alone for its most important balancing tool? Looking at the positive results in neighboring countries like Germany, where capacity prices significantly decreased, it became clear that a market opening had a lot going for it. At the same time, harmonization of balancing markets on European level was moving forward with projects such as PICASSO. The pressure was rising to open and reform the Belgian aFRR market.

First steps towards an open aFRR market

In 2016, Elia cautiously started exploring the idea. The plan: set up a pilot project where pools of smaller assets could show their capabilities. In the fall of that year, candidates for the provision of aFRR were screened and tested to make sure they were able to adhere to the technical complexity of the aFRR product. They also had to fulfill a successful prequalification test in the spring of 2017. Eventually, only three parties remained, among which Next Kraftwerke. During the summer months of 2017, the pilot participants delivered aFRR in the production environment of Elia. That means they were activated and monitored just like other aFRR providers, albeit with a small volume. Participants were reimbursed at-cost for activations and no capacity payment or penalties were applied.

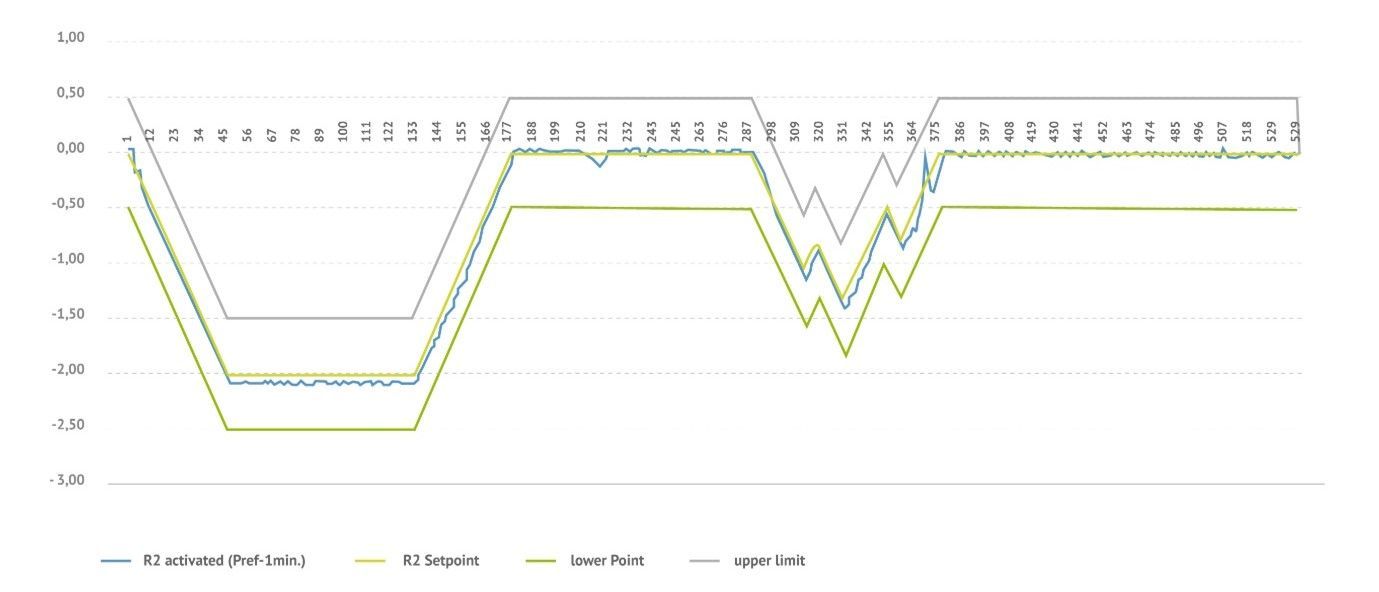

The pilot project was a valuable learning experience for Elia. Most importantly, by the end of the pilot it was clear that pools of smaller assets were technically able to deliver aFRR with satisfactory accuracy. Next Kraftwerke’s pool of 28 biogas and natural gas motors even reached a higher compliancy than some of the conventional CCGTs which had been providing aFRR for years! It was also clear that a new market design would need to pay careful attention to the baseline methodology and monitoring of the accuracy of delivery.

Developing a new market design: the stakes were high

After the pilot project had been successfully concluded, it was clear that participation of other assets than gas fired power plants in the aFRR market was not only possible, but also desirable. This required an overhaul of the market design.

The stakes were high. First of all, Elia and the CREG wanted to ensure the continuation of reasonably priced and reliable aFRR power provision. Secondly, there were several new parties eager to join the market with a variety of technologies. Thirdly, the existing aFRR providers saw their relatively comfortable position endangered. Not only was the aFRR balancing market a nice source of income, but it also allowed for portfolio optimization. Most existing aFRR providers were market parties with large portfolios, with significant imbalance exposure. aFRR activation prices set the Belgian imbalance price most of the time, so it is possible that some of these operators optimized their aFRR bids based on their overall portfolio. This opportunity would (partially) disappear once the market opened.

Various working groups were organized to discuss the transition to a new market design that would enable the entry of new providers, without a total disruption of the Belgian balancing system. For months, energy experts at Elia, existing providers, and new entrants racked their brains to find a suitable model. During the many, sometimes heated, discussions organized and moderated by Elia, the minds slowly ripened for a new market design.

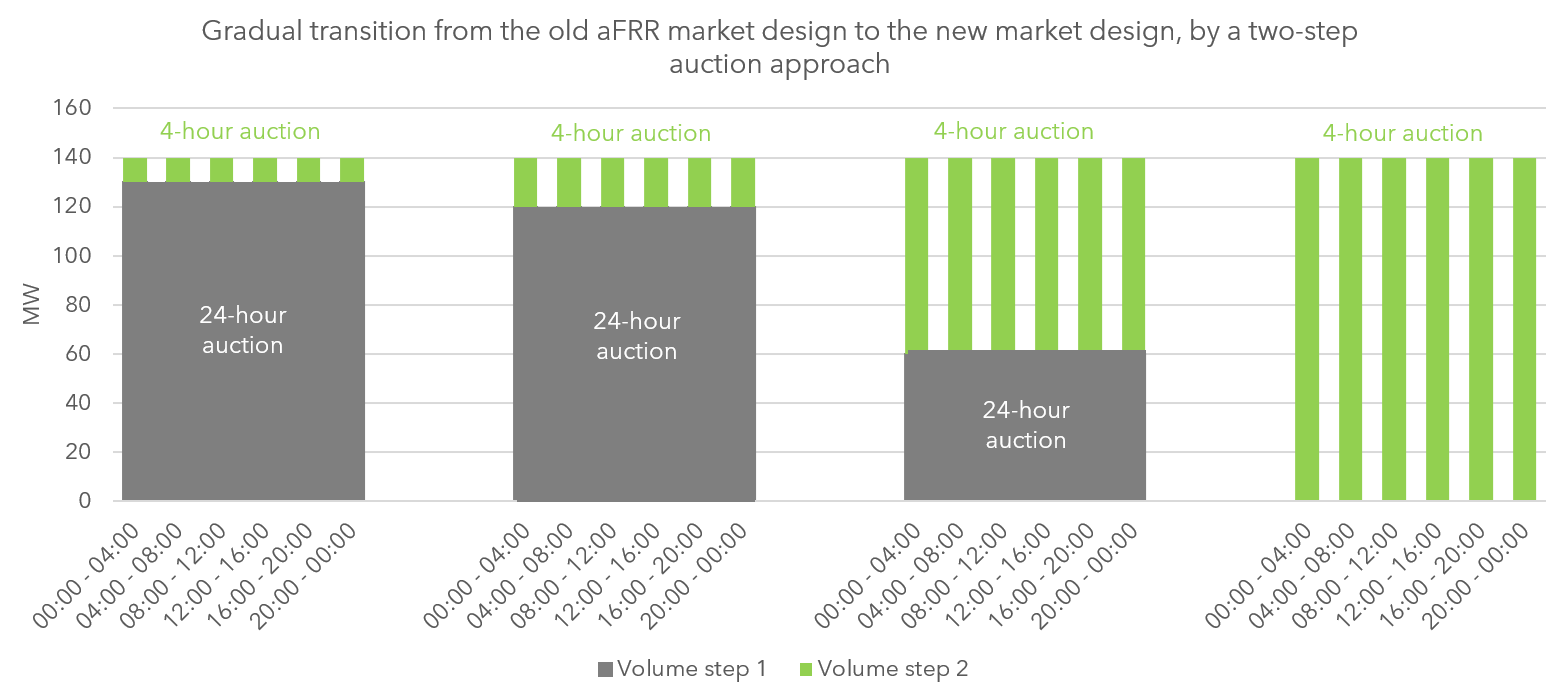

The result was a Belgian compromise, what a surprise! The new market design was unique and innovative in the way that it splits the auction for procurement of aFRR capacity in two steps. In the first step, part of the required aFRR volume is procured for the entire delivery day with the allowance to place symmetric bids. Being cleared based on total cost optimization, this first step of the auction closely resembles the old market design. In the second step, an (initially) smaller volume is procured asymmetrically in 4-hour blocks following the full merit order clearing principle. While the first step provides a secure environment for CCGTs to sell (part of) their power at competitive prices, the second step provides opportunities for renewable assets, smaller generators, and demand response. If the 4-hour auction is competitive with the auction for the whole day, more and more volume is procured in step two until it eventually replaces the first. At that point, the aFRR market has fully transitioned from its old design to a new one. The underlying intention of this setup: a gradually increasing competition between the two steps of the auction, giving time to market players to adapt and avoiding price spikes.

Extreme capacity bids - CREG pulls the ripcord

The first weeks of bidding in the fall of 2020 were observed with a mix of excitement and anxiety. The new and unique market design made sense on paper, but how would it hold up in a real-life stress test?

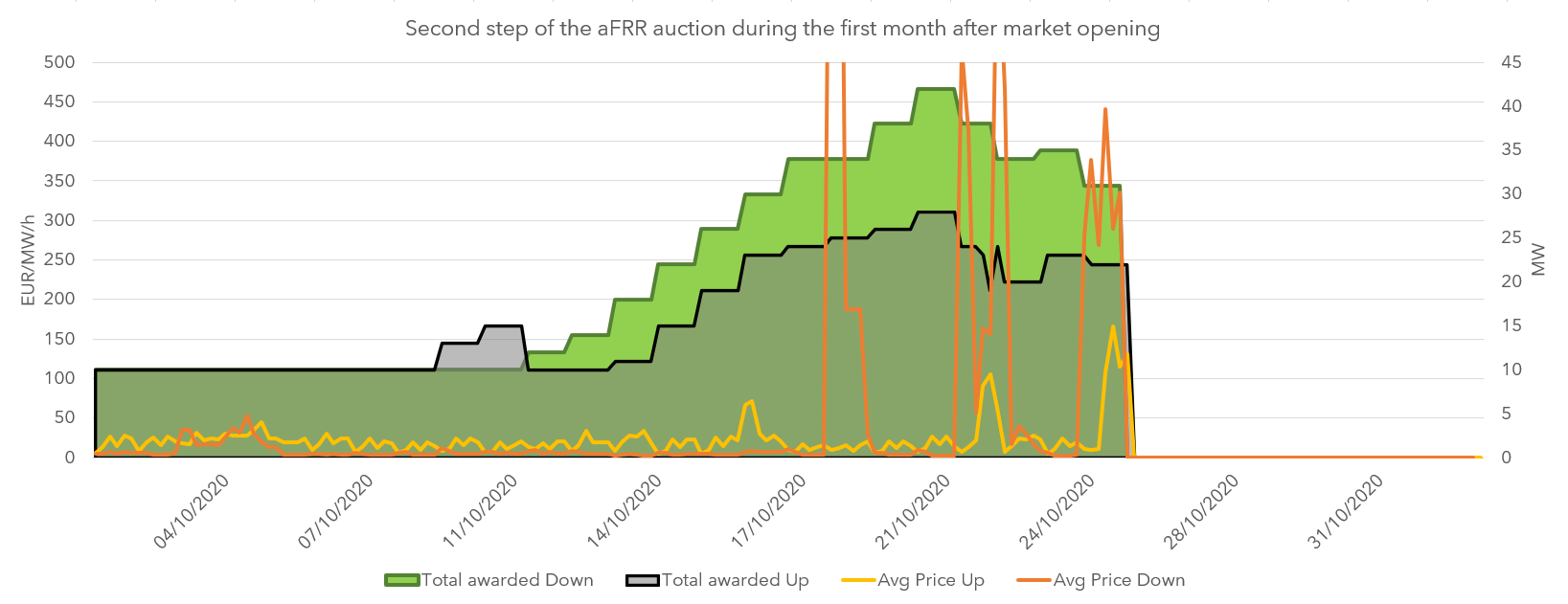

Prequalifying assets to participate in the reserve power markets takes a considerable amount of time. At the moment of market opening, no new volume made it through the accreditation process yet. This created an unexpected situation. CCGTs bid the largest part of their volume in the first step, which resembled the market design they were used to. Start-up and must-run costs could be covered in the 24-hour bid of the first step, allowing them to offer capacity cheaply in the second step with 4-hour bids. While the expected competition from new assets did not show up immediately, the cheap bids of CCGTs in step two increased the procured volume in that second step day-by-day. Within less than four weeks after market opening, the second step of the auction had grown from 10 MW to 20 MW in the upward direction, and to 40 MW in the downward direction. The incumbent aFRR providers were outcompeting themselves!

“Isn’t that great?”, one could think. The market design was doing its job, gradually increasing the volume being procured in the asymmetric 4-hour auction blocks. Yet, the CCGT operators found themselves in the situation that they had to offer so much power in the second step (by lack of competition), that they would need to start up new plants, even if only for a few MWs of aFRR. They now had to price in the must-run and start-up costs in their 4-hour bids, which drove up prices to extreme levels. The one thing Elia and the regulator had tried to avoid all these years! The regulator CREG saw no other option than pulling the ripcord on the new market design.

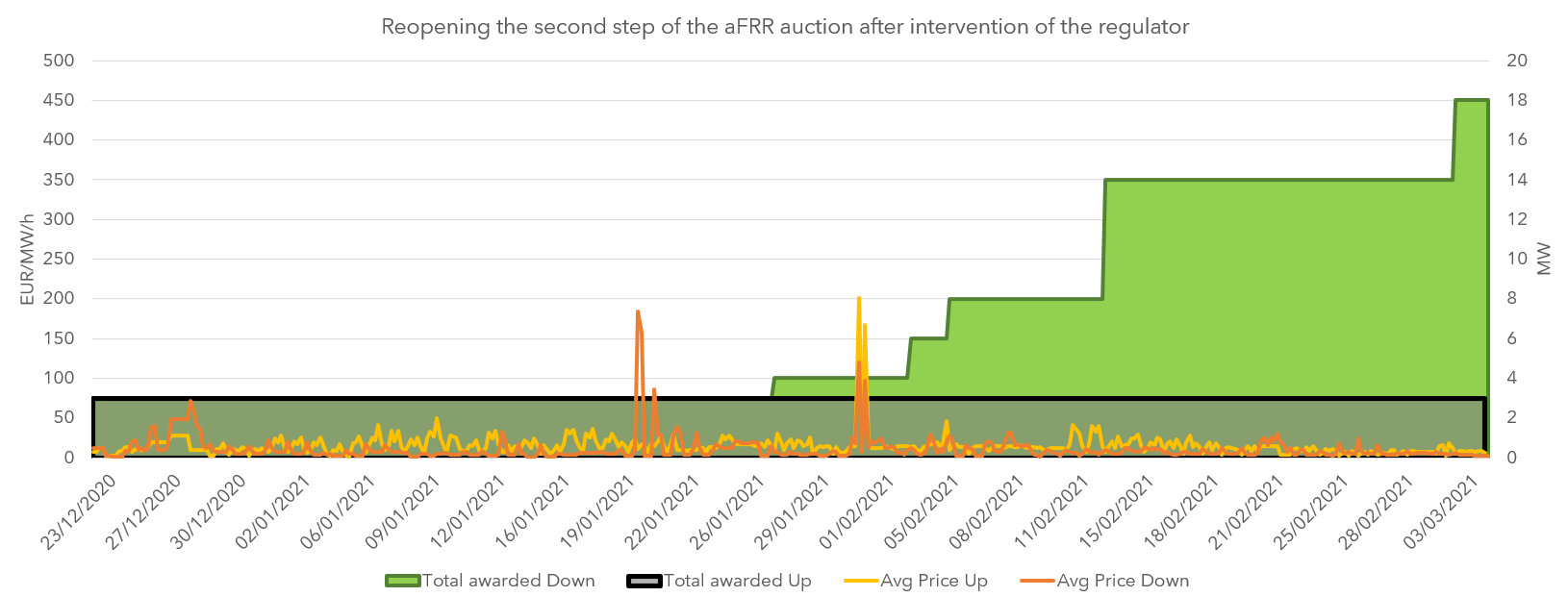

The regulator asked to put the second step of the auction on hold until new assets made it through the prequalification process. A second safety measure required that the volume procured in the second step could never be bigger than what had been prequalified by new market participants. Although these measures allowed the market to cool down, they are not a permanent solution. The second step of the auction cannot increase in size even if it is cheaper than the first step. There is hence no real competition between the two auction steps. CCGTs can make sure all their costs are covered in the first step of the auction and push new entrants out of the second step of the auction with very cheap bids. Acknowledging this issue, Elia and CREG invited all stakeholders for a review and discussion on the new market design to investigate how it could be tuned and tweaked for better results.

By the end of December, new volume did get prequalified and since then we see a rapid increase of new assets joining the aFRR market. This increasing competition should eventually lead to lower prices, but it will take some time. In this context it is important to remember that the market was not just opened for the sake of market opening. It is a necessity to join the European platforms for balancing energy in the coming years. If the Belgian market design does not yet bring prices down, joining these platforms definitely will.

Read more

In conclusion

From an aggregator’s point of view, the pace of the aFRR market opening is generally perceived as slow. At the same time, Elia’s initial hesitation and cautious approach in the opening of the aFRR market is understandable. After all, aFRR was and is their most important tool to keep the Belgian grid balanced. If the light goes out, they bear all the blame. Yet, in view of the energy transition, a closed aFRR market with an oligopoly of gas fired power plants simply does not cut it anymore.

Even though Elia needs to let go of the old paradigm in which their SCADA system has almost direct control over each and every aFRR providing asset, it does not mean that reliability will suffer. A well-developed monitoring and penalty scheme ensures market parties respond accurately to their setpoints, even if it is a pool of decentralized installations. Having a service delivered by more but smaller assets in fact increases reliability, by reducing the bulk loss risk, which we discussed at length in an earlier blog post.

With a unique market opening plan, allowing a gradual increase of decentralized (and renewable) aFRR providers, Elia paves the way for a new market dynamic and the integration with European balancing platforms. Was the new design flawless? Clearly not. The first months have been hectic and have shown large price fluctuations. The market design was not prepared for all possible scenarios and the regulator had to step in when capacity prices soared. That does not mean the whole rulebook needs to go back to the drawing board. Many design elements are good, but some changes are due. We look forward to participating in the discussions with Elia and other market parties to achieve a well-functioning market.

Once the 4-hour auctions prove consistently competitive with the daily auctions reserved for large power plants, the unique aFRR auction design allows the market to ease into a new reality. A reality where participation of decentralized assets is possible and can grow over time, while still ensuring Elia can procure enough aFRR volume to safely run the Belgian grid.