What is the Carbon Bubble?

Definition

The carbon bubble, also called CO2 bubble, is a theory that has its origin in climate and economic research. The term describes a possible overrating of companies that could only maintain their growth forecasts for the next few years by consuming fossil fuels on a scale that would violate the two-degree limit of the Copenhagen Treaty.

Table of Contents

- Can fossil energy consumption still create sustainable economic growth?

- Carbon bubble: CO2 emissions worldwide

- The remaining amount of CO2 is shrinking rapidly

- Which companies are included in the Carbon Bubble?

- Risks on the securities market coming up

- CO2-emitting companies are changing their investment strategy

- Outlook and conclusion: How can we prevent the carbon bubble from bursting?

Can fossil energy consumption still create sustainable economic growth?

How can climate protection be reconciled with an economy still based primarily on the combustion of fossil fuels? The two-degree limit in the Copenhagen Treaty defines a clear framework: If we will not be able to limit the global warming to two degrees Celsius until the year 2100, irreversible climate effect will occur – and economic damage running into trillions.

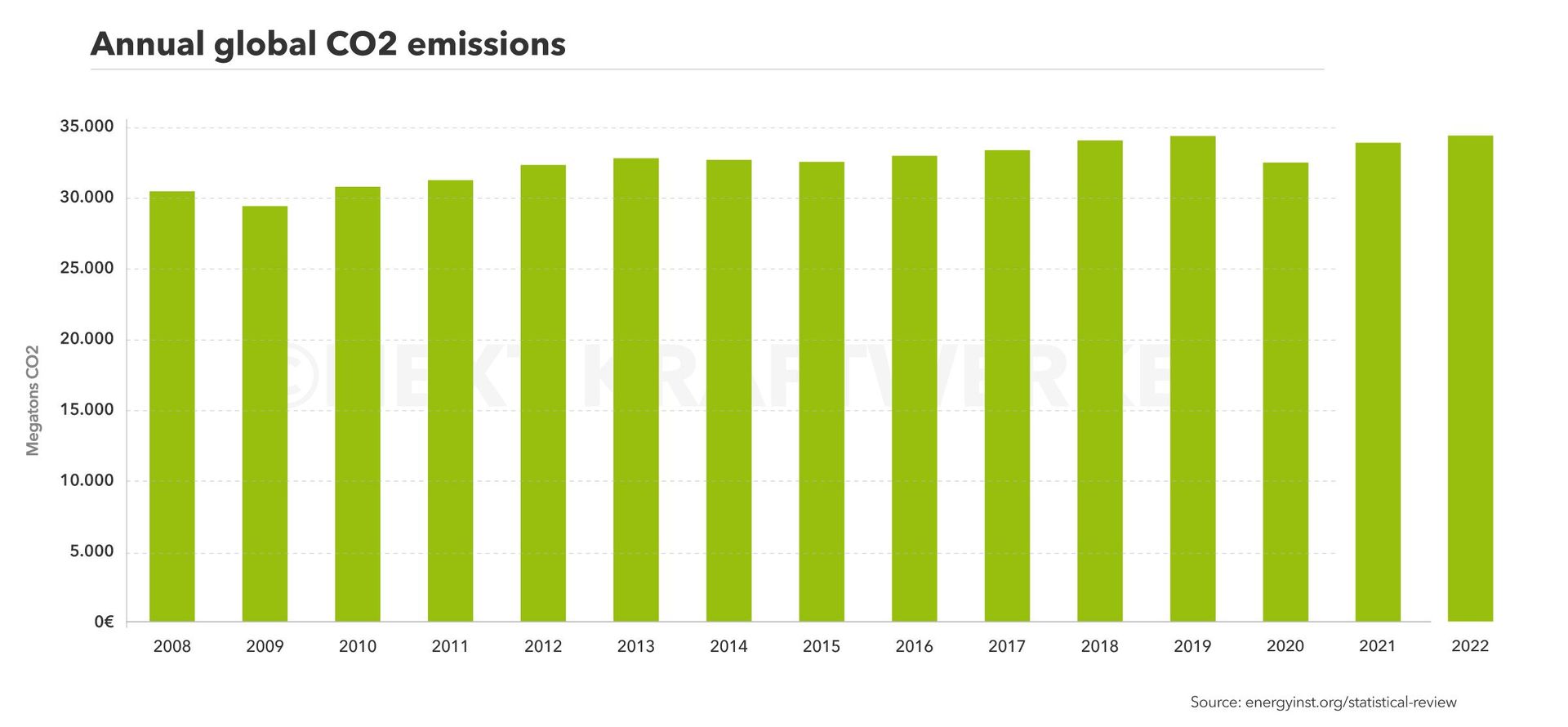

Carbon bubble: CO2 emissions worldwide

Against this background, economists from the Carbon Tracker Initiative believe that it is more than questionable whether growth forecasts of companies based on the consumption of fossil fuels with CO2 emissions above the two-degree limit are really sustainable. This is because the damage caused by CO2 emissions would have to be offset against the consequential costs of exceeding the two-degree limit. However, this would have the consequence that the profits and thus the company values would shrink very strongly would develop more probable, into losses. The theory of the carbon bubble describes exact this risk of loss of corporate.

The remaining amount of CO2 is shrinking rapidly

For some decades now, world climate research has agreed on a "budget" of 886 gigatonnes of CO2 for the period 2000 to 2050. If we exceed this amount, the two-degree limit is overstepped. Trouble is: From 2000 to 2010 we have already emitted 321 gigatonnes of CO2; from 2010 to 2020, assuming an annual growth rate of one percent from 2018, we can expect additional 330 gigatonnes. As a result, there will be only 236 gigatonnes of CO2 left from 2020 on - a quantity that will probably be depleted before the end of the decade.

What these figures mean for the fossil energy industry becomes clear in a calculation by the Carbon Tracker Initiative: In 2010, the 100 largest coal-producing companies, together with the 100 largest oil and gas-producing companies, had bunkered an emission potential of 745 gigatonnes of CO2 in deposits all over the world. At that time, however, the remaining CO2 budget was only 565 gigatonnes – burning this potential would so already have meant an excess of 180 gigatonnes. At least this share should therefore have been included in coal and oil company figures as early as 2010; instead, it now forms a significant part of the carbon bubble.

Which companies are included in the Carbon Bubble?

One thing is clear: The world can only meet even the less ambitious climate targets if the consumption of fossil fuels is cut-off or massively reduced immediately. Taking a lignite-fired power plant as an example, this means that it must not extract and burn the coal that is essential for its value creation – right now, and not in the 2030s when the race for the world climate will presumably be over. The same applies, of course, to oil and gas producing companies. The expensive mining rights for fuels acquired decades ago lose a lot of value or would even become worthless and serve as bloating material for the carbon bubble.

This problem affects not only the commodity companies, but also the energy sector: Electricity production plants burning lignite, hard coal or oil would change from profitable assets to financial burdens in the balance sheets of energy companies. The subsequent loss in value of company shares would not only affect private investors, but also municipalities: many cities and municipalities are shareholders of fossil energy companies and depend on dividends.

However, there are not only companies that directly promote climate-damaging energy sources that populate the carbon bubble. In addition, companies from the automotive industry, which are still indirectly dependent on mineral oil, can no longer sell wide parts of their product range with a drastic CO2 limit. The development of electric vehicles offers a way out - but these will powered with electricity from renewable sources and manufactured in CO2-neutral factories. However, switching to electric drives mean losses in the automotive supply industry – electric vehicles do not need combustion engines, gearboxes and fuel systems anymore.

Risks on the securities market coming up

Overall, the Carbon Tracker Initiative estimates the value of all fossil energy reserves at USD 27 trillion - albeit based on current commodity prices. If the fuels can no longer be burned, their market value will inevitably fall - possibly to below the cost of mining rights, production and distribution. Long-term securities invested in fossil fuels, which have so far guaranteed good returns thanks to rising prices, would be seriously affected by a fall in prices.

The Bank of England had already identified the securities for CO2-emitting commodities and companies slumbering in many portfolios as a risk as early as 2015. Additionally, the British central bank warned of annual costs of hundreds of billions of dollars for the search for new fossil deposits that can no longer be amortized by the commodity companies due to the carbon bubble.

More to read

CO2-emitting companies are changing their investment strategy

In the global coal and oil companies, the warnings take effect: International commodity companies are going on a global shopping spree to "green-wash" their portfolios, which is a frequent accusation by press and public. But: If they want to survive economically in a decarbonizing world, they must free their value chain from CO2 emissions and leave the carbon bubble.

However, it is doubtful that this really happens with full commitment: In 2018, for example, multinational oil companies invested just one percent of their total budget in renewable technologies. Although these are by no means peanuts in view of the three-digit billion Euro sales volume on the global oil market, they are only a small part of a still mainly CO2-intensive business.

Outlook and conclusion: How can we prevent the carbon bubble from bursting?

Much has happened since 2013, when the Carbon Tracker Initiative first introduced the theory of the carbon bubble:. Back then, for example, the share of renewable energies in Germany’s power production was at 27 percent - according to Fraunhofer ISE projections, it could be over 47 percent in 2019. Business models in the field of renewable energies have developed, matured and are ready for the market and can ensure a stable power supply.

Nevertheless, even in 2019, the big divestment, the global withdrawal from company shares and investments based on fossil fuels, has by no means yet taken place. In April 2019, the New York Times quoted the economist Jeremy Grantham, one of the first and most accurate prophets of the 2008 financial crisis, in drastic words: We would be faced with the "first truly global financial bubble" - and not only companies that rely on fossil fuels, but the entire global economy would be affected. Most investors, however, continue to act with a shortsighted perspective, consistent with John Maynard Keynes' thesis that it is better for ones reputation to fail conventionally than to succeed unconventionally. According to Grantham, he knows of no prospects for the future that are as well documented and more probable then climate change - and yet hardly anyone acts accordingly.

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.