What does Merit Order mean?

Definition

In the energy industry, the merit order principle refers to the order in which power plants are deployed on an electricity trading platform in order to ensure the economically optimal supply of electricity to the grid. The merit order is based on the lowest marginal costs, i.e. the (operating) costs incurred by a power plant for the last megawatt hour produced. These variable costs are usually the fuel costs of conventional power plants. The merit order does not take into account the fixed costs of an electricity generation technology - for example, the construction or dismantling costs of a power plant are irrelevant for the order of deployment of power-generating capacity in the context of the merit order principle.

The power plants that continuously produce electricity at very low cost are the first to feed power into the grid in accordance with the merit order. Power plants with higher marginal costs are then added until demand is covered.

The merit order is just one possible model for describing a functional electricity market. It assumes that power plant operators are always trying to cover the cost of the next megawatt hour produced; they would not produce it otherwise. Power plants with low marginal costs can therefore offer a lower price for their electricity, and they are in turn called upon more often than power plants with higher marginal costs. The merit order is designed to shed light on how pricing works in a liberalized electricity market; it is not a fixed "law" or regulation that coordinates the use of power plants.

Table of Contents

- Price Formation

- Merit order effect (MOE)

- Limits of the Merit Order Model

- Alternatives to the Merit Order Model

Price Formation

On the electricity exchange, prices result from the interplay between supply and demand. The so-called market clearing price (MCP) is the last bid to be accepted. The power plant with the most expensive marginal costs - the marginal power plant - defines the exchange price for all power plants deployed at a given time. The energy industry refers to this pricing mechanism as "uniform pricing" or "pay as cleared", as all power plants are paid the same price for their feed-in, even if they have previously bid different (lower) prices.

If power plants are able to offer a lower price than the marginal power plant, they can generate a surplus. This margin, the contribution margin, offsets their own fixed costs.

Merit Order Effect (MOE)

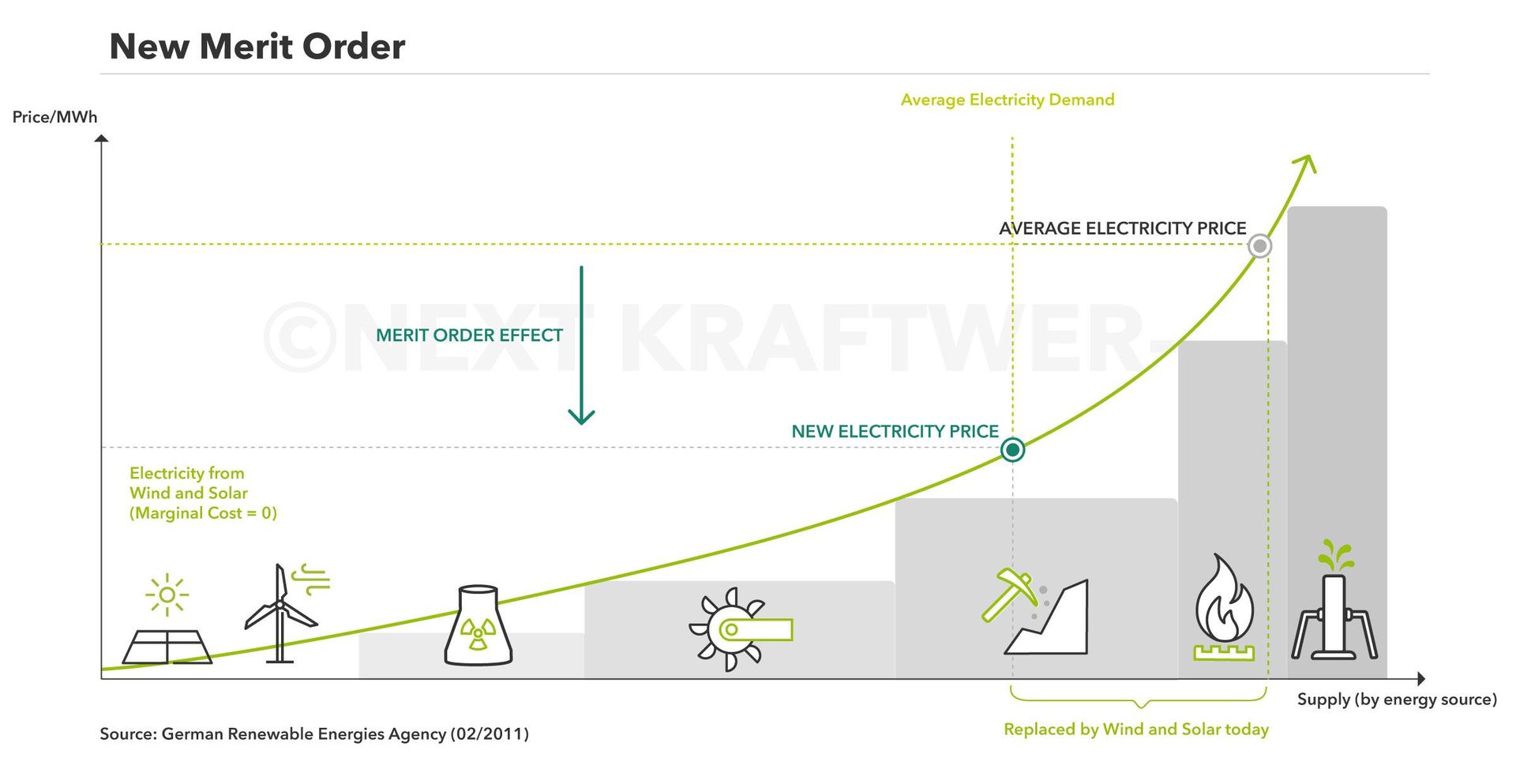

Permanently declining electricity production costs – especially in renewable power generation – have caused the merit order sequence to shift, with conventional power plants taking a position further back. The effect is quite visible with the increasing feed-in of renewable energies (such as photovoltaics, wind, or biomass). Fluctuating photovoltaic and wind power plants have marginal costs close to zero as they have no fuel costs like coal or gas-fired power plants. They are advancing into the market and are pushing conventional power plants – e.g. gas peakers – toward the end of the merit order during peak load periods. The energy industry describes this phenomenon as the merit order effect (MOE) of renewable energies. Only the residual load – the remaining electricity demand that renewable energies cannot cover – must still be provided by conventional power plants

Limits of the Merit Order Model

The merit order model is a static description model that is well suited for representing short-term electricity price formation, especially on spot markets.

Calculating the long-term development of electricity prices, however, requires a market model that takes long-term effects into account. Such an electricity market model would include factors such as operator decisions on deployment, expansion, and decommissioning as well as fixed operational costs. The latter point is particularly relevant: no power plant operator will want to build additional plants if selling electricity only covers marginal costs (see Missing Money Problem). For example, the enormously high investment and dismantling costs of nuclear power plants are not correctly reflected in the merit order model nor are the real environmental impact costs of coal or gas-fired power plants or the actual total costs of renewable energies.

The merit order model also focuses on explaining how electricity trading via the spot exchange works - but this is not the only way to trade power. The vast majority of electricity trading does not take place via short-term electricity trading on the spot exchange, but via OTC contracts, power purchase agreements (PPAs) and futures trading. The merit order principle may have an influence on the pricing of these long-term contracts, but in a weakened, indirect way that is difficult to quantify.

It should be noted that the merit order principle is by no means synonymous with the concept of electricity market design as a whole - the former is merely a subset of the latter. This is because many other factors influence the pricing of electricity, from subsidies for fossil and renewable power plants to taxes and levies and the aforementioned long-term electricity contracts.

More to read

Criticism of the Merit Order Principle

In recent years, the merit order principle has often been the focus of debate in the energy industry - and in some cases even beyond. A structural problem of liberalized electricity markets without capacity mechanisms (in which the mere provision of electricity generation capacities is financially remunerated in addition to the energy produced) plays a role here, the so-called missing money problem.

Missing Money Problem

The missing money problem refers to the situation that electricity producers can find themselves in if they are structurally no longer or very rarely included in the merit order due to their own high marginal costs and are therefore no longer able to recoup their fixed costs. If no further income is available, for example from capacity mechanisms or subsidies, there is therefore no incentive to build new power plant capacities that are likely to be used infrequently. There is simply no money or prospect of money to make a positive investment decision ("missing money"). This primarily affects gas peakers, i.e. gas-fired power plants that are at the end of the merit order and are used to cover peak loads. Once again, the merit order principle is not the cause of the problem, but merely an adequate model to describe the situation, because in an energy-only market, the refinancing of fixed costs via price peaks at the end of the merit order is included in the equation.

Energy Crisis in 2021/2022

With the energy crisis in the wake of the Russian invasion of Ukraine, discussions about the merit order principle finally made the evening news on a regular basis, at least in parts of Europe and especially in Germany which was affected heavily by surging energy prices. After all, the merit order model was a very good explanation for the spike in electricity prices in 2021 and 2022. Astronomically rising prices for natural gas drove the marginal cost price of gas-fired power plants, which are often used to cover peak loads, to sometimes exorbitant levels. Thanks to uniform pricing, this in turn led to a sharp increase in the general price level for electricity over several months (in addition to the loss of production by French nuclear power plants), as all electricity producers now received a multiple for the electricity they produced, even if their operating costs were not at all affected by the rise in natural gas prices. It became painfully clear to the public that the fuel costs of fossil fuel power plants can still determine the price of electricity.

Alternatives to the Merit Order Model

The massive increase in electricity prices in 2022 led to a lively discussion about the merit order principle in Europe. The issue of pricing on the electricity markets has now also increasingly come onto the political agenda, resulting in efforts at EU level to decouple the electricity price from the gas price through an electricity market reform.

Replacement of Uniform Pricing with Pay-as-Bid Principle

One way to achieve this would be to abolish uniform pricing and apply the pay-as-bid principle, whereby producers receive exactly the price at which they offer the electricity they produce on the market. At first glance, the abolition of the market-clearing price would immediately decouple the gas price from the electricity price. However, many questions remain unanswered here: How would producers bid into the market in the future? Would they bid structurally higher prices in order to anticipate the price of the marginal power plant? Would the pay-as-bid principle therefore perhaps result in even higher prices than under uniform pricing? The abolition of uniform pricing therefore presents many uncertainties with regard to the expected bidder behavior and is therefore considered to be quite risky.

Alternative Pricing Mechanisms for Electricity Generators with low (or non-existent) Fuel Costs

Another proposal, which has some supporters in political Brussels, aims to differentiate between the various types of electricity generators when determining their power price. While solar, wind, hydropower and nuclear power plants have comparatively low or non-existent fuel costs - or operating costs in general - it is being discussed whether they should generally be remunerated through contracts for difference and no longer according to the merit order principle. This would mean that a large proportion of the electricity generated would no longer be priced via a uniform price, which is in fact currently linked to the gas price, while power plants with conventional fuels, i.e. gas, hard coal, lignite and oil-fired power plants, would remain in the familiar price regime.

Other alternatives based on the US model, such as nodal pricing or state-fixed producer prices, have not yet been seriously discussed. State-fixed electricity prices in particular would be diametrically opposed to the liberalization of the European electricity markets.

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.