What is mFRR (manual Frequency Restoration Reserve / R3)?

Definition

mFRR is the manual Frequency Restoration Reserve that helps to stabilize the frequency of the electricity grid. In most countries the TSO (Transmission System Operator) is responsible for its procurement and activation. The mFRR (also R3 or tertiary reserve) helps to restore the required grid frequency of 50 Hz (or in some countries of 60 Hz). This tertiary control reserve intervenes when there are longer lasting deviations in the power grid that cannot be resolved solely by the other upstream balancing services (FCR or aFRR).

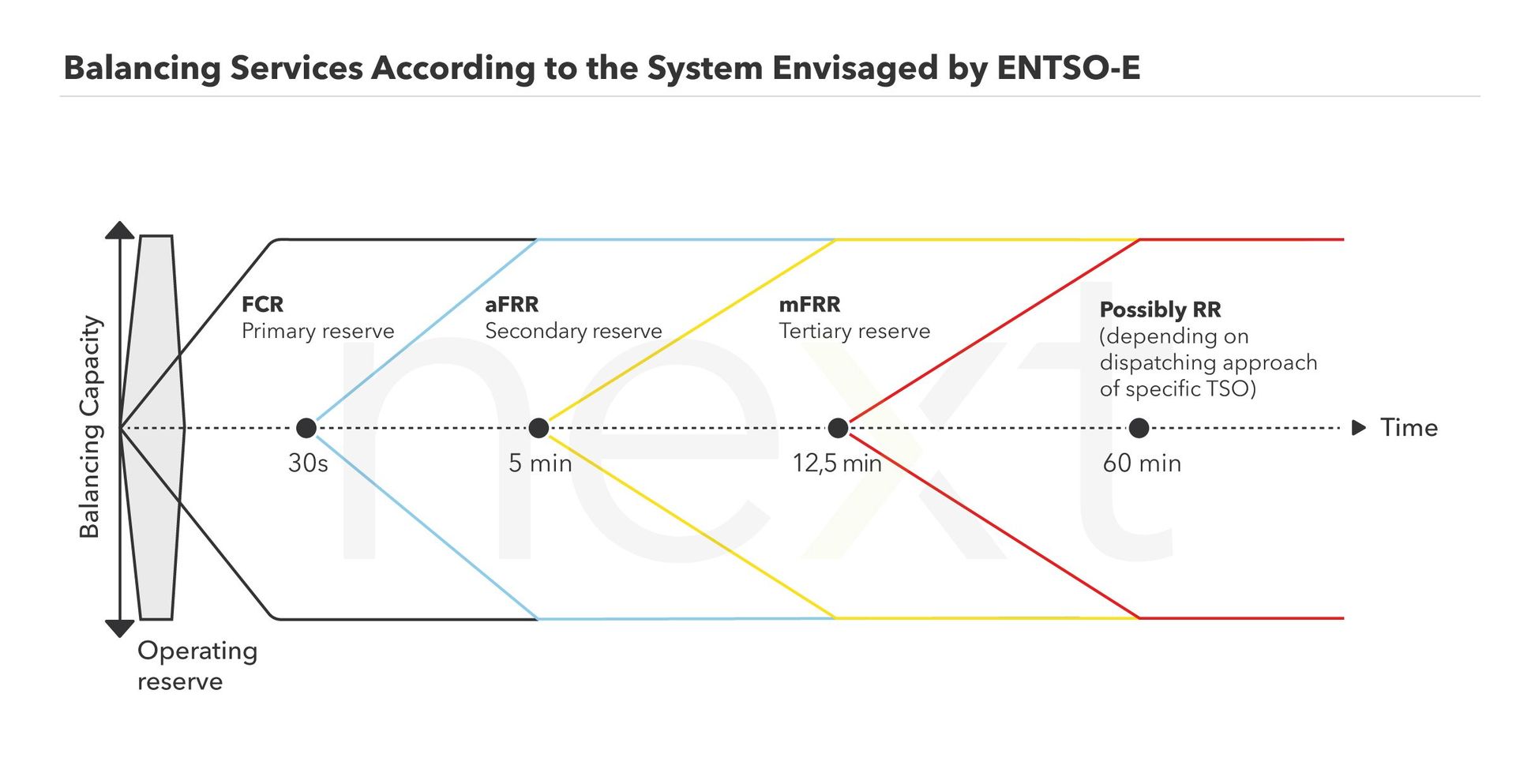

mFRR must be, according to the guidelines proposed by the European Network of Transmission System Operators of TSO in Europe (ENTSO-E), fully deployable after 12.5 minutes and has a minimum duration period of 5 minutes. Different auctions determine which Balancing Service Provider (BSP) holds back capacities and/or delivers the reserve in case of imbalances for each quarter hour.

How does mFRR work?

Manual Frequency Restoration Reserve in contrast to aFRR (automatic Frequency Restoration Reserve) isactivated manually or semi-automatically by an operator, usually by the TSO. The quantity of electricity fed into and withdrawn from the power grid must always be in balance. If, for example a consumer uses more than expected or a generation unit feeds in less than forecasted, the TSOs use balancing energy to compensate the imbalances and stabilize the grid.

It is difficult to tell the specific regulations for the mFRR worldwide as many countries have their own set of technical rules and the way TSOs or system operators procure and use mFFR volumes varies a lot. However, in most countries the specification of different balancing services are comparable to a certain extent. In the following, mFRR is explained in accordance with the ENTSO-E guidelines, which established the regulatory basis in the Electricity Balancing Guideline (EB-GL) and System Operation Guideline (SOGL). The aim of these guidelines is to further harmonize the European balancing energy markets and enable the exchange of balancing energy across national borders respectively TSO control areas.

The TSOs in general differentiate between three types of frequency restoration reserves: the short-term FCR , the aFRR, which gets activated after 30 seconds and the mFRR which supports or gradually replaces aFRR and has a Full Activation Time (FAT) of 12.5 minutes. FAT is the time period between the activation request and the full delivery of the reserve. The minimum duration period in which the full capacity of the respective bid is delivered is 5 minutes.

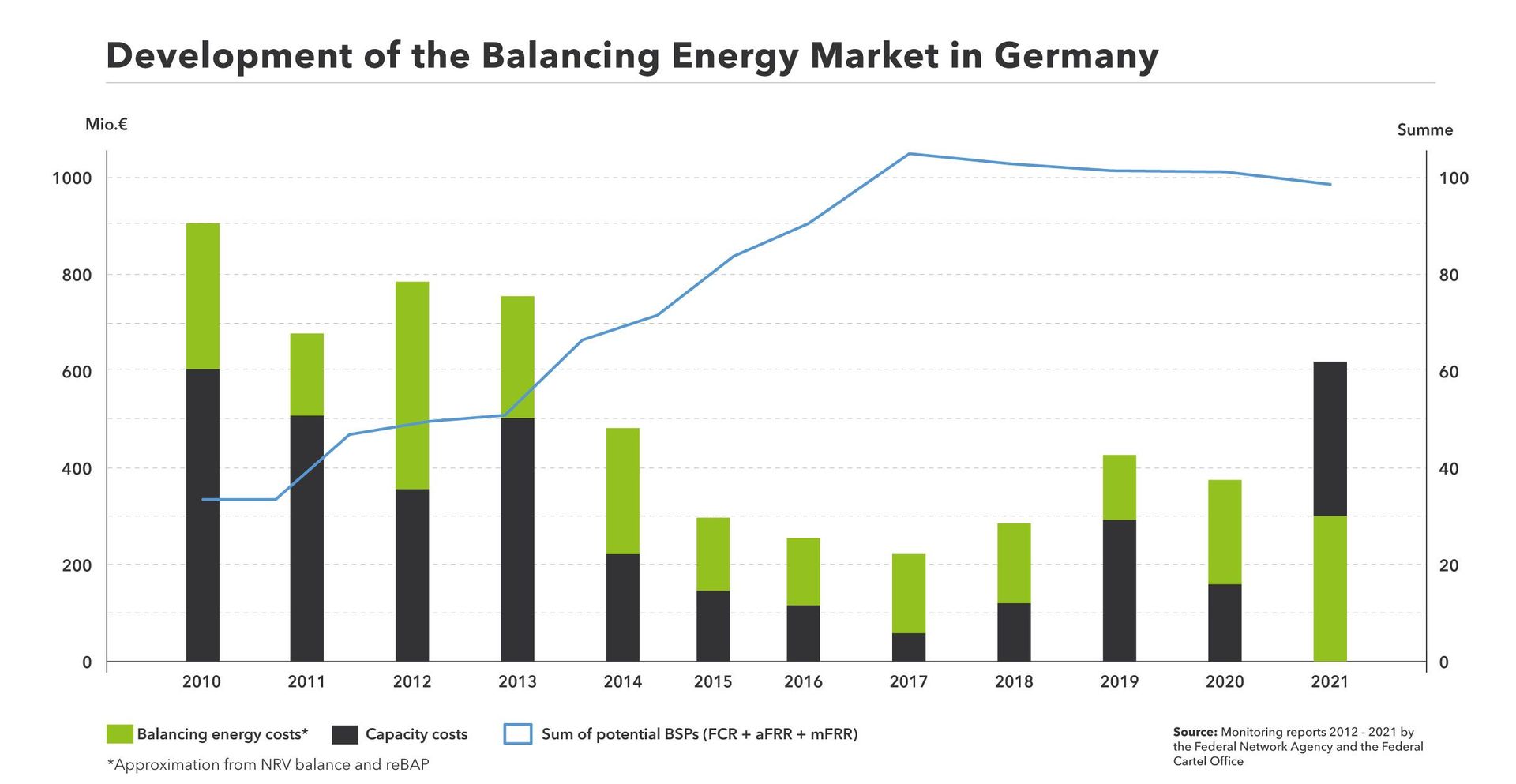

The tendered volumes are specified by the TSOs and are based on their needs as well as on historical data. In Germany, for example, tendered volumes have tended to fall over the years.

Further, for aFRR and mFRR there is positive and negative balancing capacity. Negative balancing capacity is activated when generation exceeds consumption. In contrast, the TSOs need positive balancing capacity for periods when generation is low and consumption is high.

Also in most countries there are two kinds of remuneration for the BSPs: one for keeping capacity available (capacity remuneration or capacity price) and one for actually activating capacity (balancing energy remuneration or energy price). The capacity remuneration is therefore a standby payment for the provision of capacity that in case of imbalances must be available within the set time frames of the mFRR reserve. The balancing energy remuneration or activation remuneration is the compensation for the actual delivery of the reserves.

What is the Manually Activated Reserve Initiative (MARI)?

The European Commission created the EB-GL in 2017 to organize a smooth exchange of balancing energy (amongst others) between the member states of the European Union. The EB-GL created a set of technical, operational and market rules which will unify the markets and thus make cross-border exchange of balancing energy possible in the first place.

In order to harmonize the European balancing services markets, different platforms are created with MARI being the one for pan-European trading of mFRR. Initially 19 European TSOs started working on technological solutions under the umbrella of the MARI project. In 2017 they signed a Memorandum of Understanding (MoU) and in 2018 they signed a second MoU which included 28 TSOs as well as four other TSOs and ENTSO-E as an observer. The planned go-live date of the MARI platform is June 2022. The latest accession roadmap envisages that all participating TSOs will be connected to MARI by Q2/2023.

Overview of the MARI members

| Country | TSO |

|---|---|

| Austria | APG |

| Belgium | ELIA |

| Bulgaria | ESO |

| Croatia | HOPS |

| Czech Republic | ČEPS |

| Denmark | Energinet |

| Estonia | Elering |

| Finland | Fingrid |

| France | RTE |

| Hungary | MAVIR |

| Germany | 50Hertz, Amprion, TenneT DE, TransnetBW |

| Greece | ADMIE |

| Italy | Terna |

| Latvia | AST |

| Lithuania | Litgrid |

| Luxembourg | Creos |

| Norway | Statnett |

| Netherlands | TenneT NL |

| Portugal | REN |

| Poland | PSE S.A. |

| Romania | Transelectrica |

| Slovenia | ELES |

| Slovak Republic | SEPS |

| Spain | REE |

| Sweden | Svenska Kraftnät |

| Switzerland | Swissgrid |

Mari observers:

| Country | TSO |

|---|---|

| North Macedonia | MEPSO |

| Ireland | EirGrid |

| Northern Ireland | SONI |

| Serbia | EMS |

| + ENTSO-E | - |

Auctioning of mFRR: How do mFRR tenders work?

Today, in European countries that have a liberalized and open balancing energy market, mFRR is tendered on national trading platforms that are organized by the national TSOs. On those platforms, market participants which are cleared by the TSOs to participate in the balancing market, bid the balancing energy volumes that they have in their portfolios. The rules of the mFRR auction are still different from country to country, e.g. gate closures.

To further ease the European harmonization of mFRR procurement, the ENTSO-E defines a standardized mFRR product for bids on the harmonized European balancing markets. The TSOs proposed the following characteristics in their implementation framework:

| Mode of activation | Manual |

|---|---|

| Activation type | Direct or scheduled |

| FAT | 12.5 minutes |

| Minimum quantity | 1 MW |

| Maximum quantity | 9,999 MW |

| Bid granularity | 1 MW |

| Minimum duration of delivery period | 5 minutes |

| Validity Period | Scheduled activation: only at the point of scheduled activation Direct activation: anytime during 15 minutes after the point of scheduled activation |

While those characteristics shall be standardized, others remain within the responsibilities of the countries. Like for example:

- Preparation period (max. 12.5 minutes)

- Ramping period (max. 12.5 minutes)

- Deactivation period

- Maximum duration of delivery period

Besides the characteristics mentioned above, there are also foreseen guidelines for variable characteristics that each bid provided to the platform needs to have:

| Price | In €/MWh |

|---|---|

| Price resolution | 0.01 €/MWh |

| Location | Details under national responsibility. At least each bid shall contain the smallest LFC (Load Frequency Control) area or bidding zone. |

| Divisibility | BSPs can submit divisible and indivisible bids. The smallest activation granularity is always 1 MW. |

| Technical links between bids | BSPs shall provide information whether there is a mutual exclusivity of bids in consecutive quarter hours or in the same quarter hour. |

| Economical link | Economical links can be made for economical optimization e.g. exclusive group orders or parent-child linking (the child bid can only be activated when the parent bid is) as long as they are not adding decisively to the complexity of the algorithm. |

In general the bids are accepted according to the merit order principle – starting at the bid with the lowest price and continuing to do so until the demand is met.

In case of MARI this gets a little bit more complicated because the transmission capacities between national borders must also be taken into account. The cross-border capacities are still limited and the cross-border interconnectors are bottlenecks of the European electricity grid. Therefore the activation optimization function (AOF) is used to arrange the bids in the common merit order list (CMOL). The AOF calculates in addition to the price other variables like cross-border capacities. Based on On the AOF a CMOL is created for each quarter hour.

Further, the limited cross-border capacity makes the determination of pricing more complicated. Instead of marginal pricing, cross-border marginal pricing is used. The marginal price is the price of the last bid that was accepted. Perfect competition is assumed: BSPs offer their marginal costs, which in this model usually allows cheaper prices compared to pay-as-bid procedures. In the case of MARI, cross-border marginal pricing is used, which, in very simplified terms, takes into account cross-border capacity limitations. For more detailed explanations of the methodology of price determination, there is an explanatory document of ENTSO-E.

More to read

How have costs and the need for mFRR evolved?

Most markets that have already allowed renewables or aggregators to provide mFRR saw a drop in costs. This is partly because increased competition led to lower prices to have a chance of gaining a place on the merit order list.

A major milestone in achieving a market integration of RES plants in the mFRR markets is the drop of the minimum quantity in some countries to participate in the auctions and the opening of the market to aggregators (Virtual Power Plants) that bundle smaller decentralized assets, which are otherwise too small to take part in the market.

What is expected after the full implementation of MARI? When looking at the already existing European balancing cooperations, a general decrease in costs for the balancing services is likely. Those cooperations have been able to achieve cost savings in the triple-digit million range per year.

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.