What is Market Coupling?

Definition

The term market coupling refers to the aim to form an interconnected (European) market for electricity. Market coupling is intended to link control areas and market areas in order to harmonize different systems of electricity exchanges and, in particular, to reduce price differences. This way, the electricity market is to some extent aligned with the physical reality of electricity flows, since neighbouring electricity grids are in any case physically interconnected and electricity always takes the shortest route from producer to consumer - across market boundaries. Market coupling systems (PCR, FBMC and XBID) exist both in day-ahead trading and in intraday markets. This is also valid for electricity markets outside Europe, but the details provided here refer to the European market only.

Table of Contents

- Milestones on the way to the European Single Market

- PCR - The key to the pan-European electricity market

- The PCR is based on three premises:

- Market coupling in detail: What exactly is happening?

- How does this work in detail?

- Flow-Based Market Coupling (FBMC)

- Further optimizations are planned:

- NEMO - Nominated Electricity Market Operator

- Who can be a NEMO?

- Tasks of the NEMOs

- NEMOs Day-Ahead Market (Data: 05/2022)

- NEMOs Intraday-Market (Data: 05/2022)

- XBID: Cross-border intraday trading for more market efficiency

Milestones on the way to the European Single Market

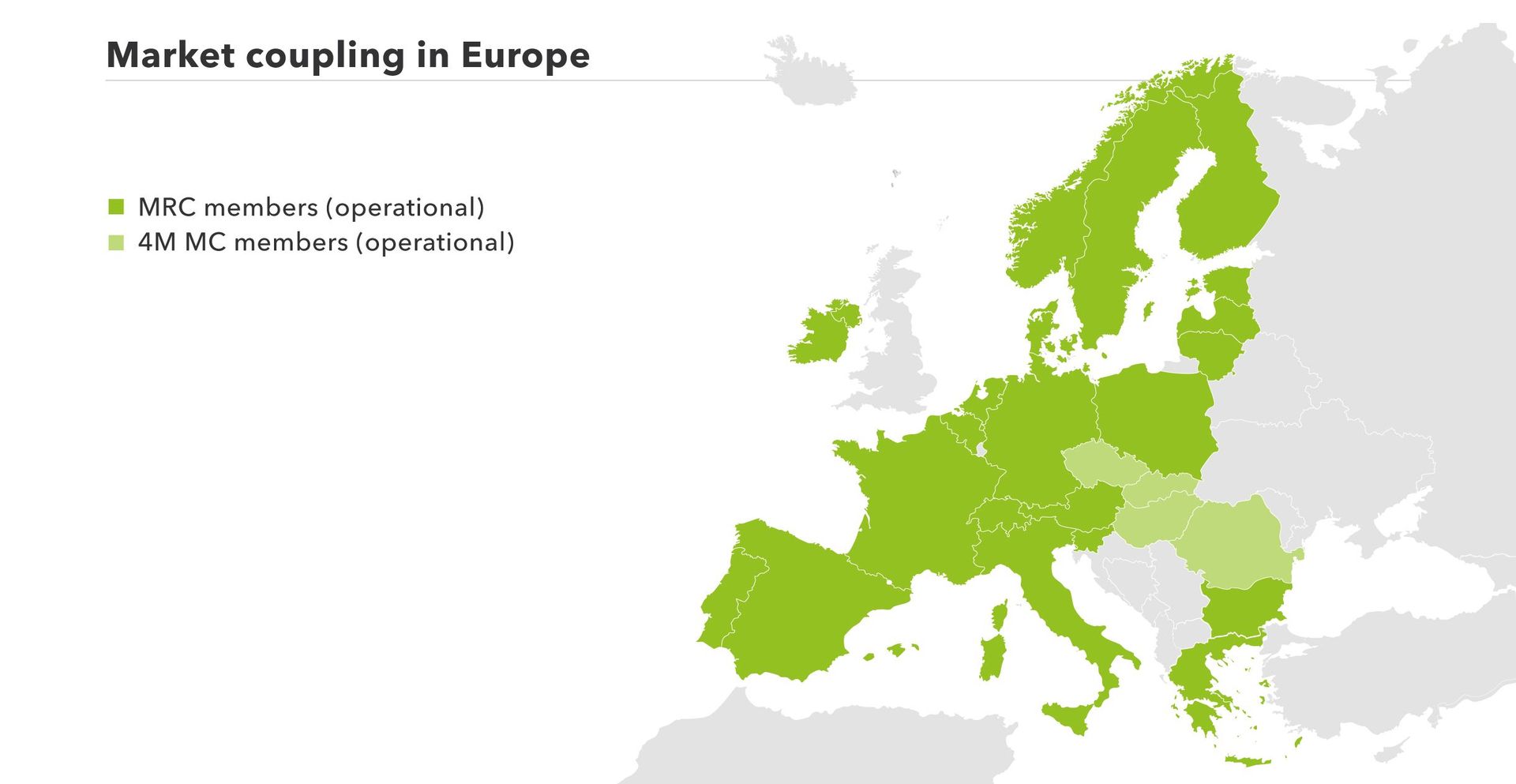

The beginnings of European market coupling go back to 2006, the year in which the first transnational merger took place: Belgium, France and the Netherlands coupled their day-ahead markets in order to make optimum use of cross-border electricity capacities and increase market liquidity. The necessary conditions were provided by EC Regulation No. 1228 of 2003 and EC Directive 2006/108/EC of 2006.

Germany and Luxembourg joined the Trilateral Market Coupling (TMC) in 2010 and completed the Market Coupling Western Europe (CWE). To date, this is the largest merger of European electricity exchanges and transmission system operators (TSOs), which in turn are also organized in ENTSO-E.

The "Pentalateral Energy Forum" - consisting of the energy ministers of the five participating states - is still the higher authority within this framework and strives for a better integration of the Central West European electricity markets. It also adopts, among other things, rules on cross-border security of supply.

In 2007, a bilateral market splitting was realized between Portugal and Spain (SWE). This merger allowed the Portuguese and Spanish day-ahead markets to grow together into an integrated market called MIBEL with the joint electricity exchange OMIE.

At the same time, Scandinavia was connected to the Western European electricity market by submarine cables: electricity has been flowing between Germany and Denmark since 2007 and between the Netherlands and Norway since 2011 – however the coupling system is not very efficient and has therefore been designed as a temporary solution, as the name "Interim Tight Volume Coupling" - ITVC for short - suggests.

In 2013, Austria joined the CWE Group and began to link its market with the other Western European electricity markets. In addition, the Pentalateral Energy Forum decided to accept Austria as a full member and Switzerland as an observer.

With the help of the Price Coupling of Regions (PCR) system introduced in 2010, the European countries implemented a nationwide market coupling of a total of 15 European countries in 2014, including the Baltic States, Great Britain and Poland in addition to the CWE and the Scandinavian countries. The SWE states joined this market coupling of northwestern European states (NWE), thus enlarging the unit area around Portugal and Spain.

The last major change was in 2015: Italy coupled its borders with France, Austria and Slovenia. July 2016 saw the successful coupling of the markets of Austria and Slovenia. This means that this area in Europe, also known as Multi Regional Coupling (MRC), currently comprises 19 European countries. At 85%, these countries cover the majority of European electricity consumption.

PCR - The key to the pan-European electricity market

Price Coupling of Regions (PCR) is seen as an important step towards a harmonized electricity market through market coupling in Europe; seven European electricity exchanges (APX-ENDEX, Belpex, EPEX SPOT, GME, Nord Pool Spot, OMIE and OTE) developed the joint price coupling. The common goal of the power exchanges is the best possible calculation of electricity prices and the efficient utilization of cross-border allocations.

The PCR is based on three premises:

- A uniform algorithm for calculating electricity prices ensures growing transparency and order within the day-ahead market.

- The PCR members do not collect the data on a central server, but manage it decentrally.

- The individual power exchanges have their own responsibility for their market areas. So-called PCR-Matcher and a Broker Service calculate the different market and reference prices.

According to EPEX-Spot - one of the seven PCR initiators - other European power exchanges may also join the PCR solution in order to guarantee even greater efficiency. Market participants can benefit from cross-border trading.

Market coupling in detail: What exactly is happening?

Originally, transnational electricity trading and the necessary allocation of transport capacities were two separate markets. Through so-called implicit auctions, market coupling combines the previously separate trading transactions into an integrated electricity market.

How does this work in detail?

All TSOs send their cross-border transport capacities to a Market Coupling Operator (MCO) - such as Transmission System Operator Security Cooperation (TSC). This is the interface between the TSOs and the power exchanges. The MCO models centrally and independently the capacity values. The TSOs and the MCO validate and monitor the values and exact cross-border capacities permanently. In the next step, the MCO transmits the capacity values to the electricity exchange. Once this is done, the electricity traders can submit their offers. The actual coupling is then carried out by the relevant electricity exchanges: they settle supply and demand using an algorithm accepted by all partners. However, all players need to compare their capacity values once again before publication.

The system’s underlying market coupling is therefore based on several control mechanisms to ensure maximum efficiency.

Flow-Based Market Coupling (FBMC)

On May 20th, 2015, the CWE states implemented the so-called flow-based market coupling (FBMC) in Central Western Europe. The application of the FMBC is limited to the CWE internal borders (D-NL, D-F, F-B, NL-B) so far. In parts, the FBMC allocates transmission capacities at the same time as the market clearing on the electricity markets takes place. This is a departure from the usual available transfer capacity (ATC) with capacity allocation prior to market clearing. The FBMC ensures greater cross-border transport capacity through the closer integration of capacity allocation and market activity.

Further optimizations are planned:

- Promotion of supplier competition

- Strengthening network security

- Minimization of price differences

A recent paper by scientists from KU Leuven in Belgium called for an evaluation of the data since the introduction of the FBMC. According to the paper, the European TSOs should cooperate more closely, as there are still differences in coordination. Furthermore, the configuration of the market areas should be reconsidered. Market coupling and the underlying methods for calculating cross-border transport capacities are therefore not a completed process, but subject to continuous optimization.

NEMO - Nominated Electricity Market Operator

The European Union pursues the vision of a pan-European electricity market in which the market areas of the member states link together by market coupling in order to ensure the most efficient possible market. Each country of the European Union participating in market coupling must therefore nominate one or more so-called Nominated Electricity Market Operators (NEMOs) per bid zone in accordance with the EU Commission Regulation 2015/1222. The national supervisory authorities nominate the NEMO (or the NEMOs) for their area of responsibility.

These NEMOs must establish the secure functioning of the various market coupling mechanisms in the joint European network. Together with the transmission system operators (TSOs), the electricity market participants and the regulatory authorities, their task is to enable the completion and efficient functioning of the EU's internal electricity market. This includes the best possible management and, together with the TSOs, sustainable technical development of the common transmission networks.

Who can be a NEMO?

A NEMO is always a market operator, typically an electricity exchange, which takes on specific tasks in the role of the NEMO. As an example: In Germany three NEMOs are currently competing with each other: The EPEX Spot, EXAA from Austria and Nord Pool from Norway are responsible for the German bidding zone.

Tasks of the NEMOs

As described above, NEMOs are market operators in regional or national markets and, together with the TSOs and the regulatory authorities, have to perform the following tasks:

- Acceptance of orders (bids) from market participants

- The overall responsibility for matching and allocating these orders according to the results of the single day-ahead market coupling and the single intraday market coupling.

- Publication of prices

- Settlement and clearing of contracts resulting from trading transactions in accordance with jointly agreed rules

On the technical side, the NEMOs develop and maintain the algorithms, systems and procedures for single day-ahead market coupling and single intraday market coupling. Furthermore, they process input data for cross-border capacity management and collect, validate and transmit the data generated by market coupling. In addition to joint responsibility for the single day-ahead and intraday markets, a NEMO can also be responsible for only one of the two markets.

The activities of the NEMOs also consist of many other tasks, which Article 7 of the EU Regulation 2015/1222 describes in detail. In principle, however, in principle, the NEMOs are the main institutions responsible for the common European internal electricity market and occupy an extremely important position within the market coupling structure, precisely because of the continuous exchange with TSOs and market participants.

NEMOs Day-Ahead Market (Data: 05/2022)

| Land | NEMO | Status | Marktumfeld | Zuständige Regulierungsbehörde |

| Austria | EPEX Spot SE | passporting | competitive | E-Control (Austrian regulator for electricity and natural gas markets) |

| EXAA AG | designated | competitive | E-Control (Austrian regulator for electricity and natural gas markets) | |

| Nord Pool EMCO AS | designated | competitive | E-Control (Austrian regulator for electricity and natural gas markets) | |

| Belgium | EPEX Spot SE | designated | competitive | Minister of Energy |

| Nord Pool EMCO AS | designated | competitive | Minister of Energy | |

| Bulgaria | Independent Bulgarian Power Exchange (IBEX) | designated | monopolistisch | EWRC (Energy and water regulatory commission) |

| Croatia | CROPEX Ltd | designated | competitive | HERA (Croatian Energy Regulator Agency ) |

| Czech Republic | OTE a.s. | designated | monopolistisch | ERU (Energy Regulatory Office) |

| Denmark | Nord Pool EMCO AS | designated | competitive | DUR (Danish Utility Regulator) |

| EPEX Spot SE | passporting | competitive | DUR (Danish Utility Regulator) | |

| Nasdaq Oslo ASA | passporting | competitive | DUR (Danish Utility Regulator) | |

| Estonia | Nord Pool EMCO AS | designated | competitive | Estonian Competition Authority |

| EPEX Spot SE | passporting | competitive | Estonian Competition Authority | |

| Finland | Nord Pool EMCO AS | designated | competitive | Energiavirasto |

| EPEX Spot SE | passporting | competitive | Energiavirasto | |

| Nasdaq Oslo ASA | passporting | competitive | Energiavirasto | |

| France | Nord Pool EMCO AS | designated | competitive | CRE (Commission de régulation de l’énergie) |

| EPEX Spot SE | designated | competitive | CRE (Commission de régulation de l’énergie) | |

| Nasdaq Oslo ASA | passporting | competitive | CRE (Commission de régulation de l’énergie) | |

| Germany | Nord Pool EMCO AS | designated | competitive | BNetzA (Bundesnetzagentur) |

| EPEX Spot SE | passporting | competitive | BNetzA (Bundesnetzagentur) | |

| Nasdaq Oslo ASA | passporting | competitive | BNetzA (Bundesnetzagentur) | |

| EXAA AG | passporting | competitive | BNetzA (Bundesnetzagentur) | |

| Greece | HEnEx SA | designated | monopolistisch | RAE (Regulatory Authority for Energy) |

| Hungary | HUPX Zrt. | designated | monopolistisch | MEKH (Hungarian Energy and Public Utility Regulatory Authority) |

| Ireland | EirGrid plc | designated | competitive | CRU (Commission for Regulation of Utilities) |

| Nord Pool EMCO AS | passporting | competitive | CRU (Commission for Regulation of Utilities) | |

| Italy | GME Spa | designated | monopolistisch | Ministry of Economic Development (from 2021 Ministry for Ecological Transition), opinion by ARERA, the Italian Regulatory Authority for Energy, Networks and Environment |

| Latvia | Nord Pool EMCO AS | designated | competitive | PUC (Public Utilities Commission) |

| EPEX Spot SE | passporting | competitive | PUC (Public Utilities Commission) | |

| Lithuania | Nord Pool EMCO AS | designated | competitive | NERC (National Energy Regulatory Council) |

| EPEX Spot SE | passporting | competitive | NERC (National Energy Regulatory Council) | |

| Luxembourg | EPEX Spot SE | passporting | competitive | ILR (Institut luxembourgeois de régulation) |

| Nord Pool EMCO AS | passporting | competitive | ILR (Institut luxembourgeois de régulation) | |

| Nasdaq Oslo ASA | passporting | competitive | ILR (Institut luxembourgeois de régulation) | |

| Netherlands | EPEX Spot SE | passporting | competitive | ACM (Authority for Consumers & Markets) |

| Nord Pool EMCO AS | designated | competitive | ACM (Authority for Consumers & Markets) | |

| Poland | Towarowa Gielda Energii S.A. | designated | competitive | President of the Energy Regulatory Office |

| Nord Pool EMCO AS | passporting | competitive | President of the Energy Regulatory Office | |

| EPEX Spot SE | passporting | competitive | President of the Energy Regulatory Office | |

| Portugal | OMIE S.A. | designated | monopolistisch | ERSE |

| Romania | OPCOM S.A. | designated | monopolistisch | ANRE (Romanian Energy Regulatory Authority) |

| Slovakia | OKTE a.s. | designated | monopolistisch | URSO (Regulatory Office for Network Industries) |

| Slovenia | BSP Energetska Borza d.o.o. | designated | competitive | AGEN (Agencija za energijo) |

| Spain | OMIE S.A. | designated | monopolistisch | Ministry of Industry, Energy and Tourism |

| Sweden | Nord Pool EMCO AS | designated | competitive | Ei (Swedish Energy Markets Inspectorate) |

| Nasdaq Spot AB | designated | competitive | Ei (Swedish Energy Markets Inspectorate) | |

| Nasdaq Oslo ASA | designated | competitive | Ei (Swedish Energy Markets Inspectorate) | |

| EPEX Spot SE | passporting | competitive | Ei (Swedish Energy Markets Inspectorate) | |

| Norway | Nord Pool EMCO AS | designated | competitive | NVE-RME (Norwegian Energy Regulatory Authority) |

| EPEX Spot SE | passporting | competitive | NVE-RME (Norwegian Energy Regulatory Authority) | |

| Nasdaq Spot AB | passporting | competitive | NVE-RME (Norwegian Energy Regulatory Authority) |

NEMOs Intraday-Market (Data: 05/2022)

| Land | NEMO | Status | Marktumfeld | Zuständige Regulierungsbehörde |

| Austria | EPEX Spot SE | passporting | competitive | E-Control (Austrian regulator for electricity and natural gas markets) |

| Nord Pool EMCO AS | designated | competitive | E-Control (Austrian regulator for electricity and natural gas markets) | |

| Belgium | EPEX Spot SE | designated | competitive | Minister of Energy |

| Nord Pool EMCO AS | designated | competitive | Minister of Energy | |

| Bulgaria | Independent Bulgarian Power Exchange (IBEX | designated | monopolistisch | EWRC (Energy and water regulatory commission) |

| Croatia | CROPEX Ltd | designated | competitive | HERA (Croatian Energy Regulator Agency ) |

| Czech Republic | OTE a.s. | designated | monopolistisch | ERU (Energy Regulatory Office) |

| Denmark | Nord Pool EMCO AS | designated | competitive | DUR (Danish Utility Regulator) |

| EPEX Spot SE | passporting | competitive | Danish Energy Regulatory Authority ("DERA") | |

| Estonia | Nord Pool EMCO AS | designated | competitive | Estonian Competition Authority |

| EPEX Spot SE | passporting | competitive | Estonian Competition Authority | |

| Finland | Nord Pool EMCO AS | designated | competitive | Energiavirasto (Energy Authority) |

| EPEX Spot SE | passporting | competitive | Energiavirasto (Energy Authority) | |

| France | EPEX Spot SE | designated | competitive | CRE (Commission de régulation de l’énergie) |

| Nord Pool EMCO AS | designated | competitive | CRE (Commission de régulation de l’énergie) | |

| Germany | EPEX Spot SE | passporting | competitive | BNetzA (Bundesnetzagentur) |

| Nord Pool EMCO AS | designated | competitive | BNetzA (Bundesnetzagentur) | |

| Greece | HEnEx SA | designated | monopolistisch | RAE (Regulatory Authority for Energy) |

| Hungary | HUPX Zrt. | designated | monopolistisch | MEKH (Hungarian Energy and Public Utility Regulatory Authority) |

| Ireland | EirGrid plc | designated | competitive | CRU (Commission for Regulation of Utilities) |

| Nord Pool EMCO AS | passporting | competitive | CRU (Commission for Regulation of Utilities) | |

| Italy | GME Spa | designated | monopolistisch | Ministry of Economic Development (from 2021 Ministry for Ecological Transition), opinion by ARERA, the Italian Regulatory Authority for Energy, Networks and Environment |

| Latvia | Nord Pool EMCO AS | designated | competitive | PUC (Public Utilities Commission) |

| EPEX Spot SE | passporting | competitive | PUC (Public Utilities Commission) | |

| Lithuania | Nord Pool EMCO AS | designated | competitive | NERC (National Energy Regulatory Council) |

| EPEX Spot SE | passporting | competitive | NERC (National Energy Regulatory Council) | |

| Luxembourg | EPEX Spot SE | passporting | competitive | ILR (Institut luxembourgeois de régulation) |

| Nord Pool EMCO AS | passporting | competitive | ILR (Institut luxembourgeois de régulation) | |

| Netherlands | EPEX Spot SE | passporting | competitive | ACM (Authority for Consumers & Markets) |

| Nord Pool EMCO AS | designated | competitive | ACM (Authority for Consumers & Markets) | |

| Poland | Towarowa Gielda Energii S.A. | designated | competitive | President of the Energy Regulatory Office |

| Nord Pool EMCO AS | passporting | competitive | President of the Energy Regulatory Office | |

| EPEX Spot SE | passporting | competitive | President of the Energy Regulatory Office | |

| Portugal | OMIE S.A. | designated | monopolistisch | ERSE |

| Romania | OPCOM S.A. | designated | monopolistisch | ANRE (Romanian Energy Regulatory Authority) |

| Slovakia | OKTE a.s. | designated | monopolistisch | URSO (Regulatory Office for Network Industries) |

| Slovenia | BSP Energetska Borza d.o.o. | designated | competitive | AGEN (Agencija za energijo) |

| Spain | OMIE S.A. | designated | monopolistisch | Ministry of Industry, Energy and Tourism |

| Sweden | Nord Pool EMCO AS | designated | competitive | Ei (Swedish Energy Markets Inspectorate) |

| EPEX Spot SE | passporting | competitive | Ei (Swedish Energy Markets Inspectorate) | |

| Norway | Nord Pool EMCO AS | designated | competitive | NVE-RME (Norwegian Energy Regulatory Authority) |

| EPEX Spot SE | passporting | competitive | NVE-RME (Norwegian Energy Regulatory Authority) |

More to read

XBID: Cross-border intraday trading for more market efficiency

Since June 12, 2018, cross-border intraday trading between Belgium, Denmark, Germany, Estonia, Finland, France, Latvia and Lithuania, Norway, the Netherlands, Austria, Portugal, Sweden and Spain has been established. The system called XBID enables bids from market participants from all participating countries to be merged into a single cross-exchange trading possibility allowing for cross-border intraday trading - provided, however, that sufficient cross-border transmission capacity is available.

XBID is based on a common IT system consisting of a Standard Order Book (SOB), a Capacity Management Module (CMM) and a Shipping Module (SM). All participants must commit to these standards. The project should enable the integrated intraday market according to the objectives of the EU and, above all, make energy trading more efficient and responsive: With XBID, market participants have the opportunity to balance their balancing groups more quickly throughout Europe, which should lead to lower balancing energy costs. The electricity exchanges EPEX SPOT, GME, Nord Pool and OMIE as well as the transmission system operators of the participating countries are involved in XBID.

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.