What is a Contract for Difference?

Definition

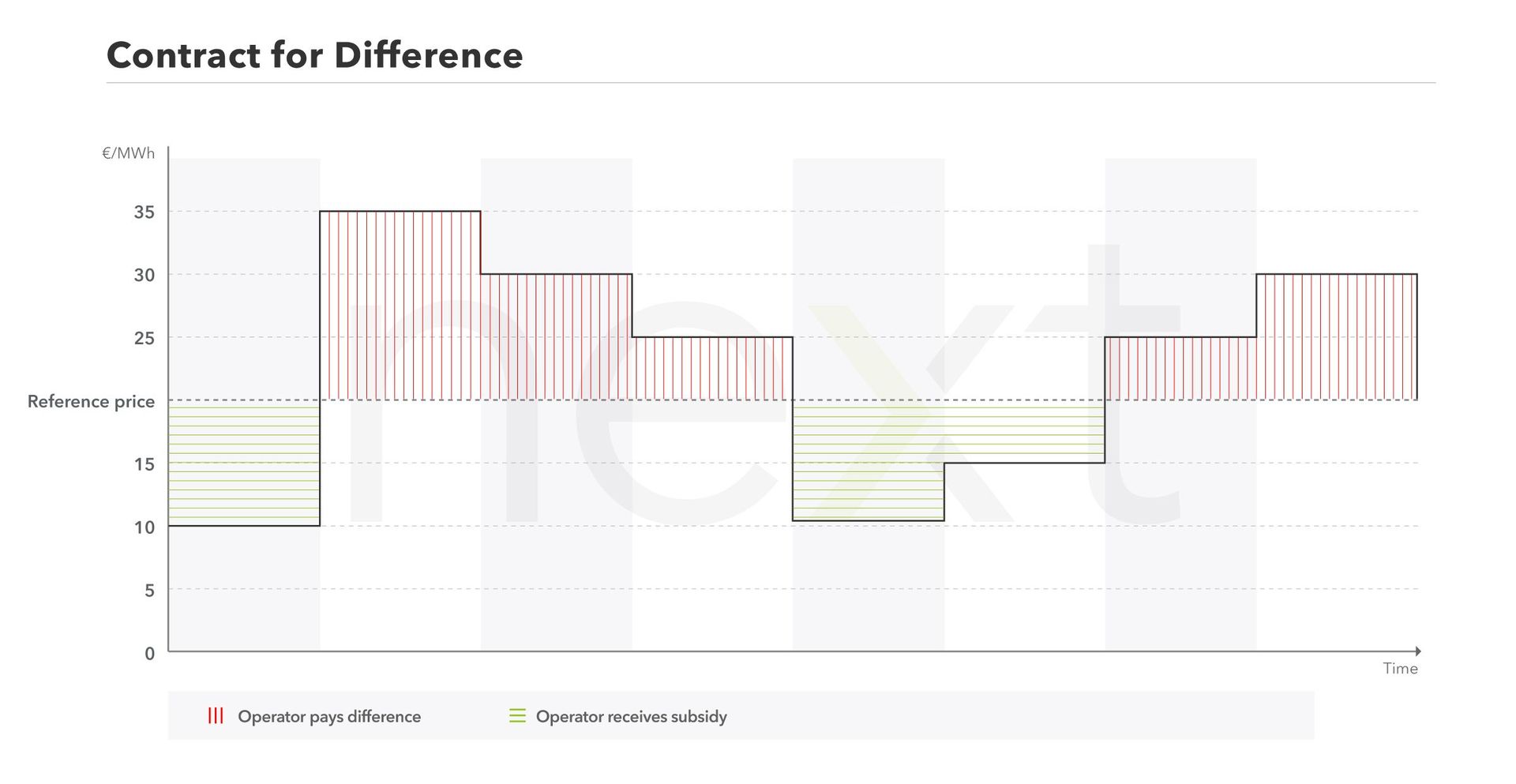

In the energy world, contract for difference is a subsidy model in which both positive and negative deviations from a fixed reference price are paid out to the contractual partner. This means that a minimum compensation is guaranteed, but revenues are capped. Contract for difference is also called symmetrical market premium.

Table of Contents

On the way to a climate-neutral electricity system and the associated intended changes to the instruments at EU level, CFDs are currently becoming increasingly important. On the one hand, the changes are intended to support the expansion of renewable energies, while on the other, the aim is to permanently avoid exorbitantly high electricity prices - such as those that occurred during the peak periods of the energy crisis and particularly impacted end consumers. The EU sees CFDs as a way of promoting renewable energies while at the same time taking revenues from plant operators that exceed a fixed upper limit. During periods of high market prices, the state can generate revenue through the levy and use it for the benefit of the general public. At the same time, CFDs offer plant operators a high level of investment security. The following CFD models can be used by the state for skimming in periods of high prices.

CFD on an Hourly Basis

Within the hourly CFD model, the plant operator receives a subsidy if the hourly reference price is below the reference value. However, if the hourly reference price is higher than the reference value, the plant operator must repay the difference between the reference value and the reference price. The reference value is usually determined through a bidding process and remains constant for the duration of the subsidy. This means that the plant operator always receives this value during this period. The reference price results from the following options for calculating the market value:

- Reference price = Day-Ahead market value / hour: The reference price for hourly CFDs equals the Day-Ahead Market value per hour.

- Reference price = Technology-specific Day-Ahead market value / hour: In this case, the reference price results from the output-weighted average of the hourly prices of a technology (e.g. PV or wind power). The use of the output-weighted average considers that volatile energy sources like wind and PV do not consistently contribute to the grid at all times. The technology-specific market value more precisely accounts for when and how much energy was fed into the grid, thus providing a more accurate reflection of the prices actually achieved in the Day-Ahead market.

CFD on a Monthly Basis

The monthly based CFD model is similar to the hourly-based model, except that the time frame extends from an hour to a month. The reference price is calculated as the following:

- Reference price = Market value / month: The market value per month is calculated from the average price of all Day-Ahead prices per month, regardless of the technology.

- Reference price = Technology-specific market value / month: The technology-specific market value per month results from the output-weighted average of the monthly prices of a technology (e.g. PV or wind power).

The following also applies to this model: If the reference price is higher than the reference value, the plant operator is obligated to repay. However, if the reference value is lower, the operator receives a subsidy – which is the difference between the reference value and the reference price.

More to read

CFD on an Annual Basis

The annual CFD also shares similarities with the CFD model on an hourly basis. However, in this model the two reference prices are calculated based on annual market values. The calculation is as follows:

- Reference price = Market value / year: The market value per year is calculated from the average price of all Day-Ahead prices per year, regardless of the technology.

- Reference price = Technology-specific market value / year: The technology-specific market value per year results from the output-weighted average of the monthly prices of a technology (e.g. PV or wind power).

Plant operators receive the difference per kWh fed into the grid if the annual reference price is lower than the reference value. However, if the annual reference price is higher, they are obliged to pay the difference per kWh fed into the grid to the state.

The CFD on a Cap-and-Floor Basis

CFD on a Cap-and-Floor basis is characterized by a corridor in which the operator can generate revenue. This corridor is bounded by the Floor as the lower limit and the Cap as the upper limit. Within this market value corridor, the operator neither receives a subsidy nor is required to repay money to the state. However, if the market value falls above the Cap within a defined period (e.g. one year), repayments are required to be made to the state. If the market value is below the Floor – and therefore below the corridor – the operator receives a subsidy.

There are various options for determining the Cap and Floor in this model:

- Within the bidding process, bids are placed on the Floor and the Cap. The winning bid is determined by the lowest average price derived from the Floor and Cap prices.

- The reference value is set as the Floor and the Cap is added to the floor at a fixed price. If the Cap is added fixed to the Floor, the Cap could be set slightly higher if an operator has bid a lower Floor. As a result, the risk arising from the lower Floor would be rewarded with a higher Cap.

- The reference value is fixed as the Floor and the Cap is set proportionally.

In December 2023, the European Union decided that in the future only bilateral CFDs based on a Cap-and-Floor system should ensure the promotion of renewable energy in the EU. Nevertheless, member states still have the option of using alternative subsidy mechanisms, as long as price ceilings are applied, similar to bilateral CFDs. The individual countries are responsible for the detailed layout and implementation of these CFDs.

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.