What is a balancing group?

Definition

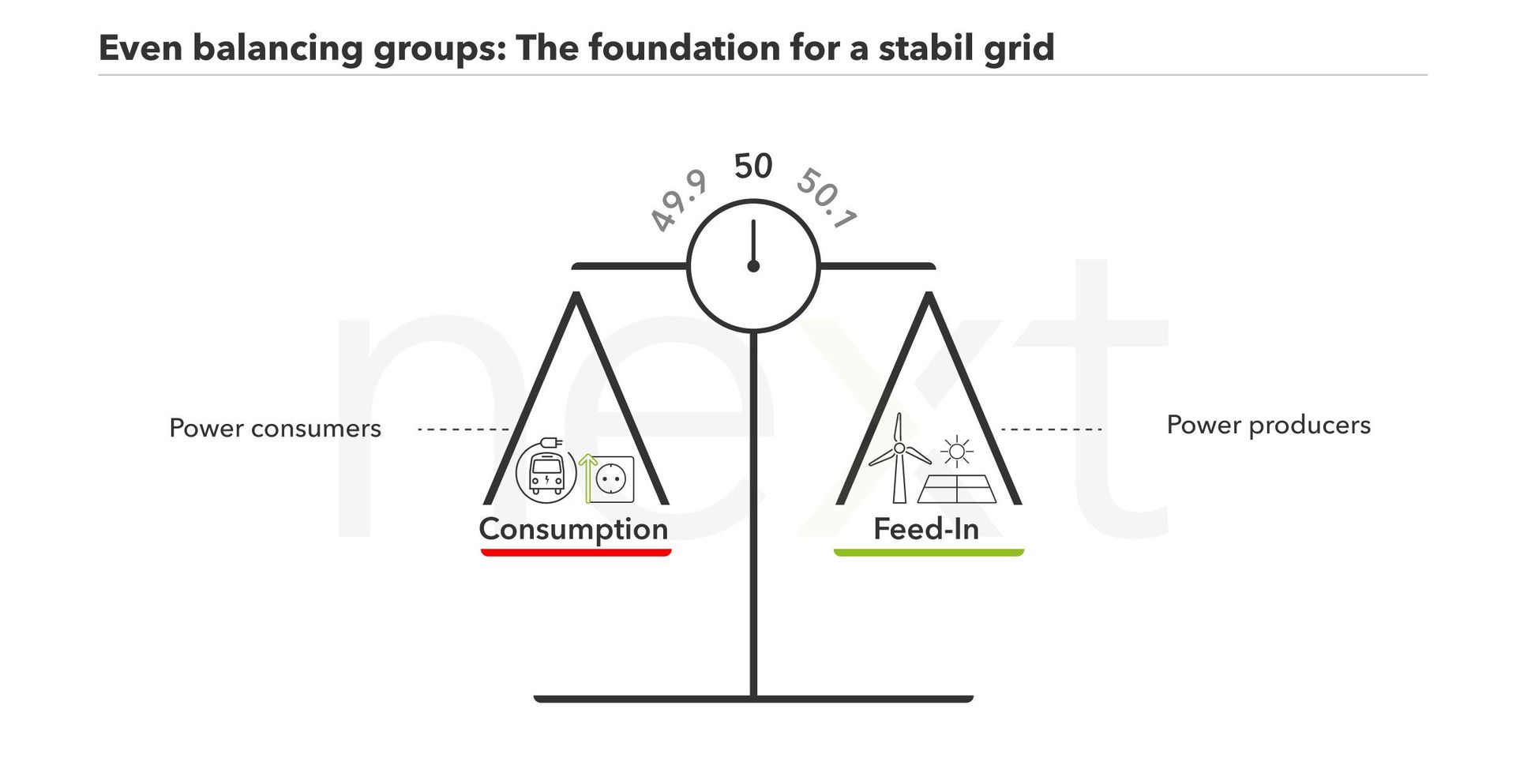

On the energy market, the balancing group (also known as the balancing authority) accounts for all power produced and/or consumed by a collection of assets within the group. Accounting for the group’s net production or consumption serves as an instrument for providing a particular operating region the precise amount of power it needs. The group manages the balancing act between power feed-in and off-take. This is designed to avoid over- and underproduction as much as possible by efficiently utilizing the power grid with minimal frequency fluctuations. Ultimately, the goal is to simultaneously match the amount of power consumed and produced within the grid.

Table of Contents

The number of balancing groups varies from country to country. Germany, as an example, has a high number of balancing groups, while the United States only has 66. Each balancing group has an ‘owner’ known as the balancing responsible party (BRP). The BRP is tasked with preparing accurate forecasts of feed-in and off-take. Additionally, the BRP regulates any power shortfalls or surpluses by trading on short-term power markets to arrive at the right amount of power for their balancing group. The BRP’s forecasts and dispatch schedules are usually transmitted to the transmission system operator (TSO) to be used in load flow calculations.

The increased prevalence of renewable energies makes these forecasts more complicated: some assets are affected by weather events or seasonable variables, resulting in volatile power production. These fluctuations can be extreme. To mitigate the risk, a balancing group should contain a diverse portfolio of both volatile and flexibly-controllable electricity producers and consumers. Biogas, CHP plants, or hydropower plants are examples of controllable power producers. Power consuming units can also provide a degree of flexibility if their operation can be shifted to different times. Batteries are also controllable, but act as both a power “producer” and “consumer.” Including easily controllable and/or geographically diverse assets in a portfolio is one important way to avoid power imbalances.

More exciting articles

Balance in the balancing group

TSOs are required to maintain balance should a discrepancy between scheduled and delivered quantities of electricity exist: They must compensate for electricity shortfalls with ancillary services to ensure a stable grid.

Here is an example to illustrate the procedure: An electricity trader manages a balancing group containing several wind turbines. This includes daily forecasts of the assets’ power production. However, an unexpected storm front ends up generating more power during certain quarter-hour intervals than the trader forecasted. The trader faces a decision: either ’smooth out’ the balancing group by selling surplus power on the intraday market for the corresponding quarter-hour interval, or, if possible, reduce power production from other assets in the balancing group. Depending on the TSO, a BRP may be subject to financial penalties in the event of an imbalance.

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.