Rising Electricity Prices in Germany – a Renewables Booster

For several months, the German power exchange prices have been moving in only one direction: straight up. In an interview with our electricity trader Jan Egidi, we take a closer look at this development and talk about the implications of this trend for the German renewables industry.

Verena Dubois: Can you summarize the price development of the last few months?

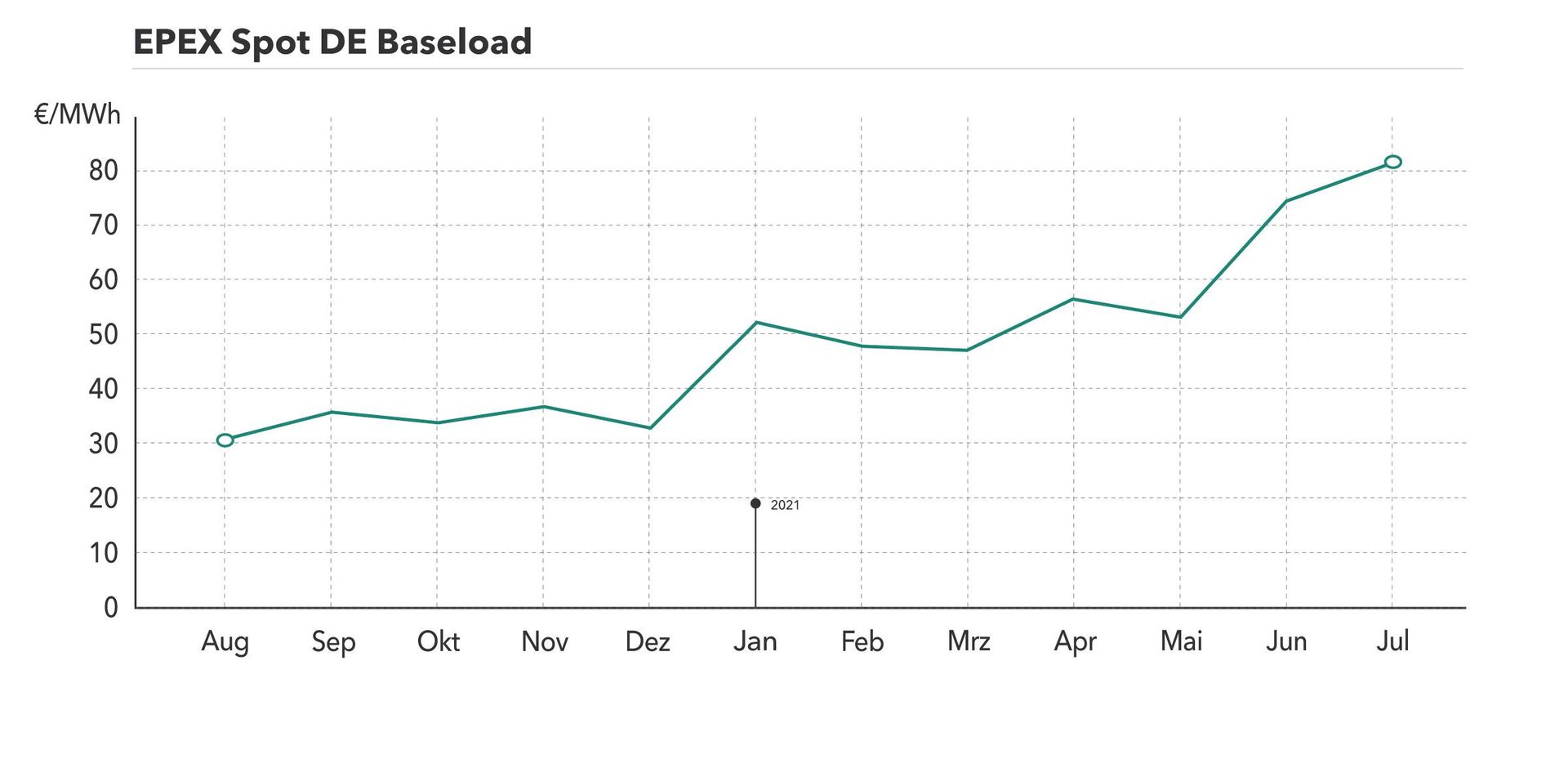

Jan Egidi: Since the beginning of the year, exchange prices have almost doubled: while the baseload in June 2020 was 45 euros/MWh, in July it was already over 81 euros. In August, we even see baseload spot prices of over 100 euros. Also the calendar year, i.e. the price for trading a whole year on the futures market, currently costs 80 euros. Last year there was a small Corona dip, when the price was 40 euros, but since then it has been going steadily upwards.

Verena Dubois: What reasons do you see for the high price level?

Jan Egidi: The main reason is the rise in fuel costs on the world market, i.e. the increase in prices for hard coal and natural gas, which ultimately also affect electricity prices in Germany. The main price driver here is the high demand for coal and natural gas from Asia. Another factor is the tension between Australia, a major coal exporter, and China, which is also causing coal prices to rise.

In addition to this world market development, there is also a European component: The CO2 price – the price that has to be paid for carbon dioxide emissions – has also risen dramatically. Last year, it was 20 to 25 euros per ton of CO2, and now it's 55 to 57 euros. So here, too, we are seeing a doubling of the price. This is due to the fact that the EU has now set even more ambitious climate targets, i.e. it wants to save more CO2 and is therefore making pollution rights scarcer. This whole mix is now causing wholesale electricity prices to rise sharply.

Verena Dubois: In recent months, we've heard that negative prices are appearing on the power exchange again and again. How does that fit in with the rising price level?

Jan Egidi: Negative prices occur especially on weekends and holidays, when high renewable feed-in meets low demand. At the moment, there is still a lack of financial incentives to switch off assets when there is a surplus of supply. Inflexible conventional power plants, which run at minimum load even on weekends regardless of current feed-in levels, also contribute to negative prices. However, the negative prices do not change the rising overall level of baseload prices. After all, the baseload is the monthly average price of all hours and very expensive hours with up to 140 Euro/MWh occur regularly. Flexible plants that can use these price spreads for a demand driven feed-in schedule are now benefiting.

More to read

Verena Dubois: What future price developments do you expect?

Jan Egidi: Future developments cannot be reliably predicted, of course, but it is interesting to see that while forward market prices for the coming years still maintain a comparatively higher level, they are slightly declining overall. Thus, the year 2023 is at 70 euros/MWh and the year 2024 already at 62 euros. The fact that prices are again trending downward here is probably related to the expansion of renewables. The more capacity is added, the lower the wholesale prices will inevitably be, because renewables offer their electricity at zero variable costs.

At the same time, however, we will also be taking German nuclear and coal-fired power plants off the grid in the coming years, which in turn will lead to a shortage of supply. The increasing demand for electricity due to the electrification of the transport sector will also play a role here.

Verena Dubois: Can you explain in detail how the price development affects the renewables industry?

Jan Egidi: For renewables, the current development is more than positive. They get the same wholesale price as conventional power plants, but they have no fuel costs. This means that while the costs of the competitors are rising sharply, their own costs remain constant or even fall. This is because it also becomes cheaper to build wind farms and solar plants. In this way, the competitiveness of renewables increases more and more. It becomes a real win-win situation when, in addition, high market prices occur. This also stimulates the construction of new plants – especially the realization of PPA projects outside the subsidy scheme.