Negative electricity prices: Fever symptoms or business as usual?

Since the beginning of the corona crisis, negative power prices have become quite common for electricity traders: In this blog, we explain how negative electricity prices develop and what is positive about them.

Imagine you fill up your car with gas, enter the cash box with a nonchalant "Pump five, please!" and you get 20 Euros paid out instead of putting them on the cashier’s table. Pure fiction? On April 20 of this year, the contract price for WTI oil slipped into negative territory for the first time in decades. Buyers of a barrel of crude oil should thus have received 40 US dollars instead of paying them. The reality, however, is, as always, a little more complex: The negative price did not immediately affect the gas station prices and heating oil is also not given away "with a surcharge". In the meantime, the oil price has also stabilized again - mainly due to trade policy agreements and not to risen oil consumption.

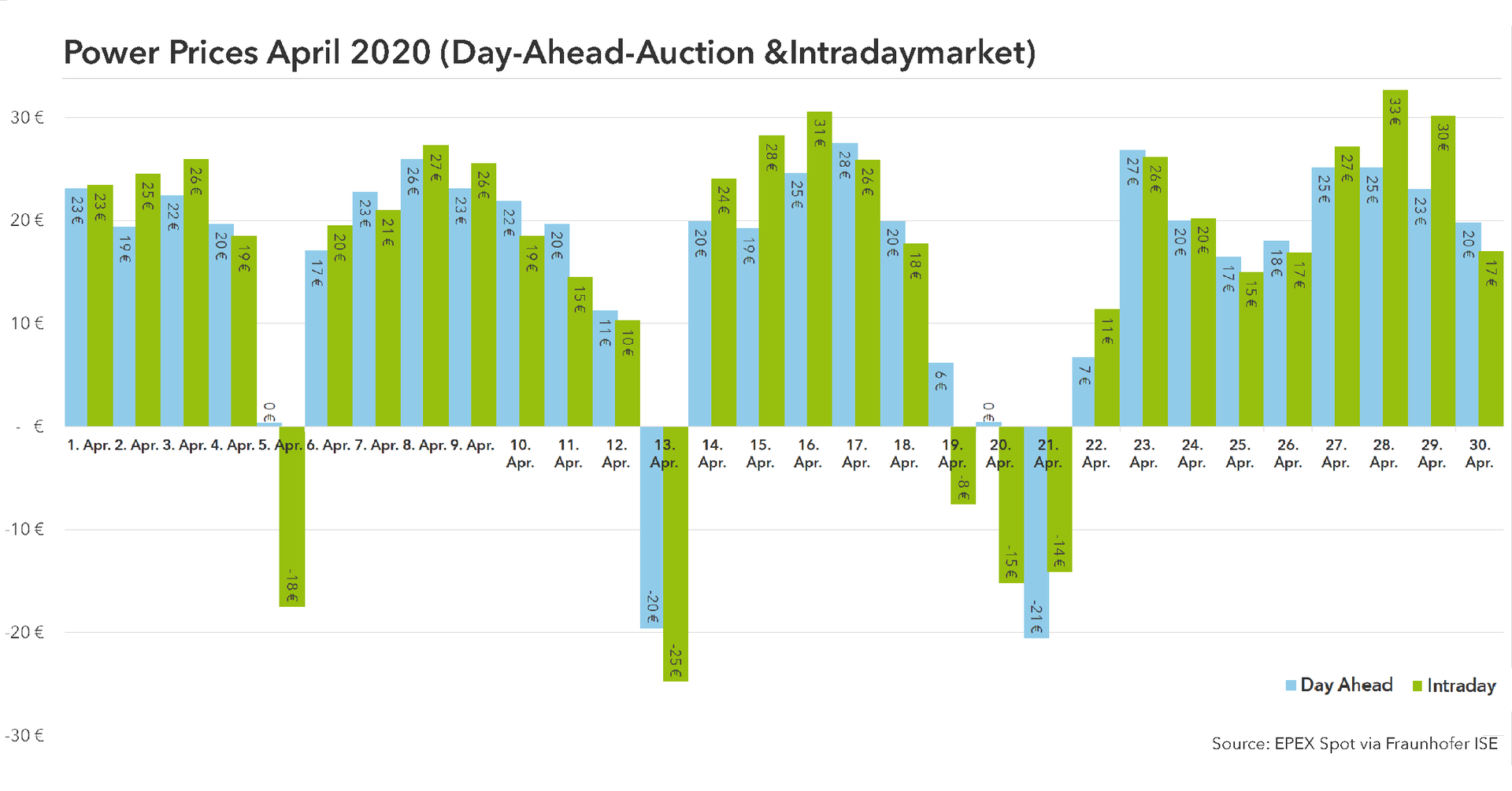

The phenomenon of negative prices on the oil market has gained a great deal of attention from the press, but on the electricity market of the 21st century, negative prices are not really newsworthy. They occur regularly, not only during a pandemic. But where do negative electricity prices come from, and do they have exclusively negative consequences? How can negative price developments be prevented – and is this prevention always desirable?

How do Negative Electricity Prices Occur?

In High School, everybody learns that market economy bases on the interaction between supply and demand. Schoolbooks make often use of apples or pears as examples: If the harvest is good, the fruit is cheap - poor harvests cause fruit prices to rise. However, apples and pears can be stored for a relatively long time: When a shortage comes up, the farmers sell the fruit from the warehouse at a reasonable price. Electricity or crude oil, on the other hand, are very hard to store in world market quantities.

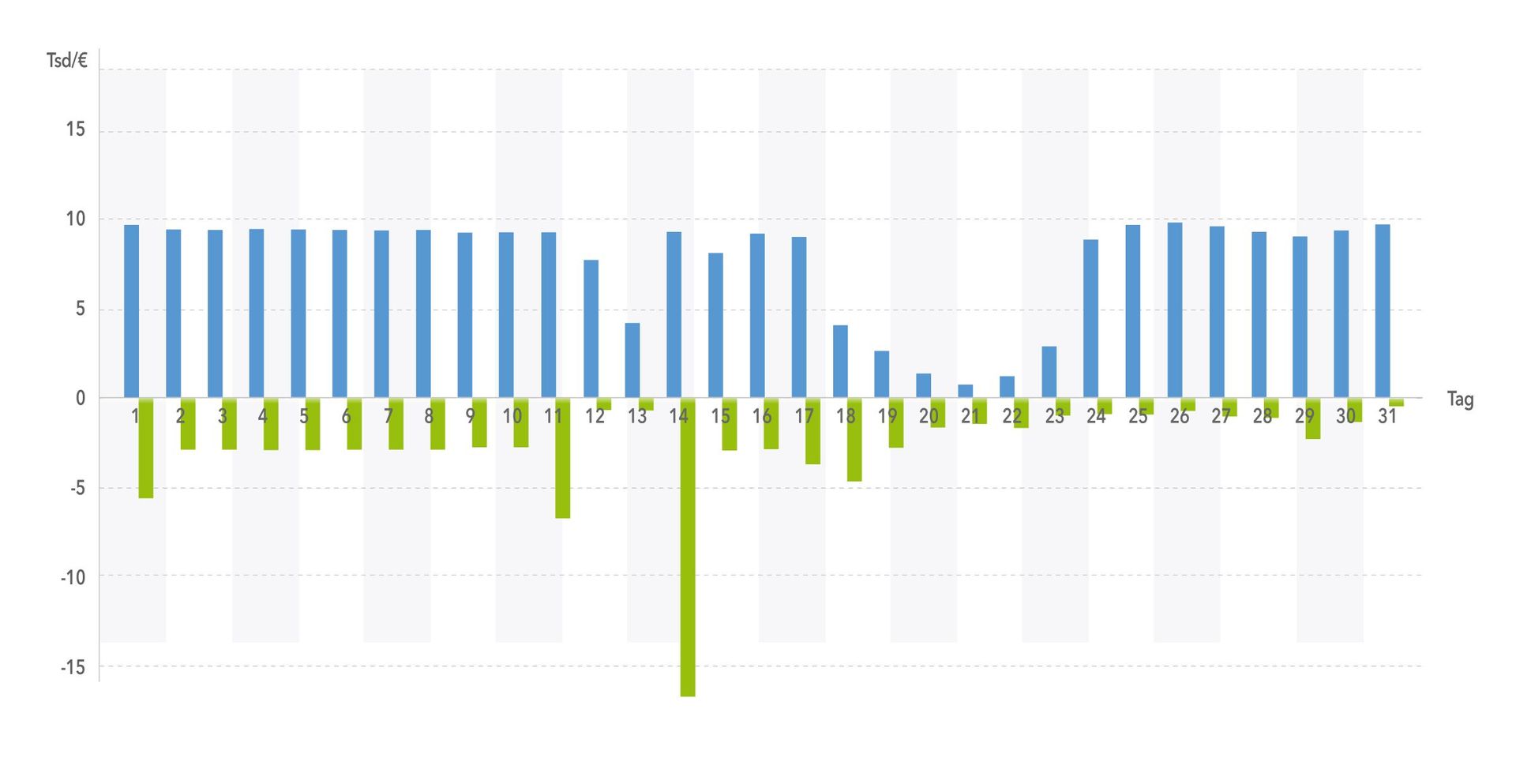

Especially electricity has to be consumed right in the moment when it is generated. Apart from small storage capacities, in comparison to the amount of generation and consumption, electricity cannot be stored in the power grid. Power market players have to forecast generation and consumption as accurately as possible and then have to take care of possible deviations with balancing energy. In the event of a short, unexpected oversupply of electricity, the transmission system operators call on negative balancing reserves. Electricity generators switch off, large consumers ramp up, both are compensated with money from the balancing reserve markets. These and other factors cause the electricity price to dropvery quickly – in the day-ahead market, in the intraday auction and in the continuous intraday market. An overproduction of electricity can therefore lead to negative electricity prices in a very short time - but how do they develop in the first place?

How Does an Oversupply of Electricity Occur?

An oversupply of electricity always occurs when power generators produce more electricity than the demand side can consume. It would therefore be logical to immediately throttle or stop the power production and activate large electricity consumers. Unfortunately, this is anything but easy in such a complex structure as the electricity system: the transmission system operators as guardians of the electricity grid do not have simple accelerator or brake pedals with which they can just throttle electricity generators. Instead, they have to send a lot of shutdown or throttling commands to all generation units in a well-coordinated manner.

Although these signals arrive within seconds, the generation unit also needs time to react. In the case of a large power plant at full load, this reaction timecan be several quarters of an hour, wind power plants have to feather their blades and stop rotating, flywheels in CHPs and turbines have to run out. In addition, there are also requirements arising from the peculiarities of the network topology. Under- and oversupply never occur evenly throughout the entire power grid. Radical shutdowns of regional power supply units are impossible due to the security of supply. "Better a few hours of negative prices than a blackout in the Ruhr area" works as a rule of thumb.

However, negative electricity prices are not an expression of market failure. In contrary, they are an expression of a working electricity market: Though they are annoying for the plant operators, power traders view them more neutrally. This is because the price is merely the signal of the relationship between supply and demand. Negative prices are no immediate signal for hectic action: In a working market system, the electricity producer consciously decides whether to produce at a negative price or not. However, negative electricity prices are noteworthy if they occur at unusual times – which brings us to the spring of 2020 with high supply and low demand due to the effects of the COVID-19 pandemic.

Do Electricity Prices Work as Fever Curve of Societies?

In the spring of 2020, almost the entire world is on an unprecedented economic and social emergency stop. From around March, the economic and social public life in most countries of the world came to an almost complete standstill. For example, Germany locked down at home and while internet connections for video streaming were running hot, the power consumption of production lines, data centers, restaurant stoves, offices, and countless other large and small consumers dropped to zero.

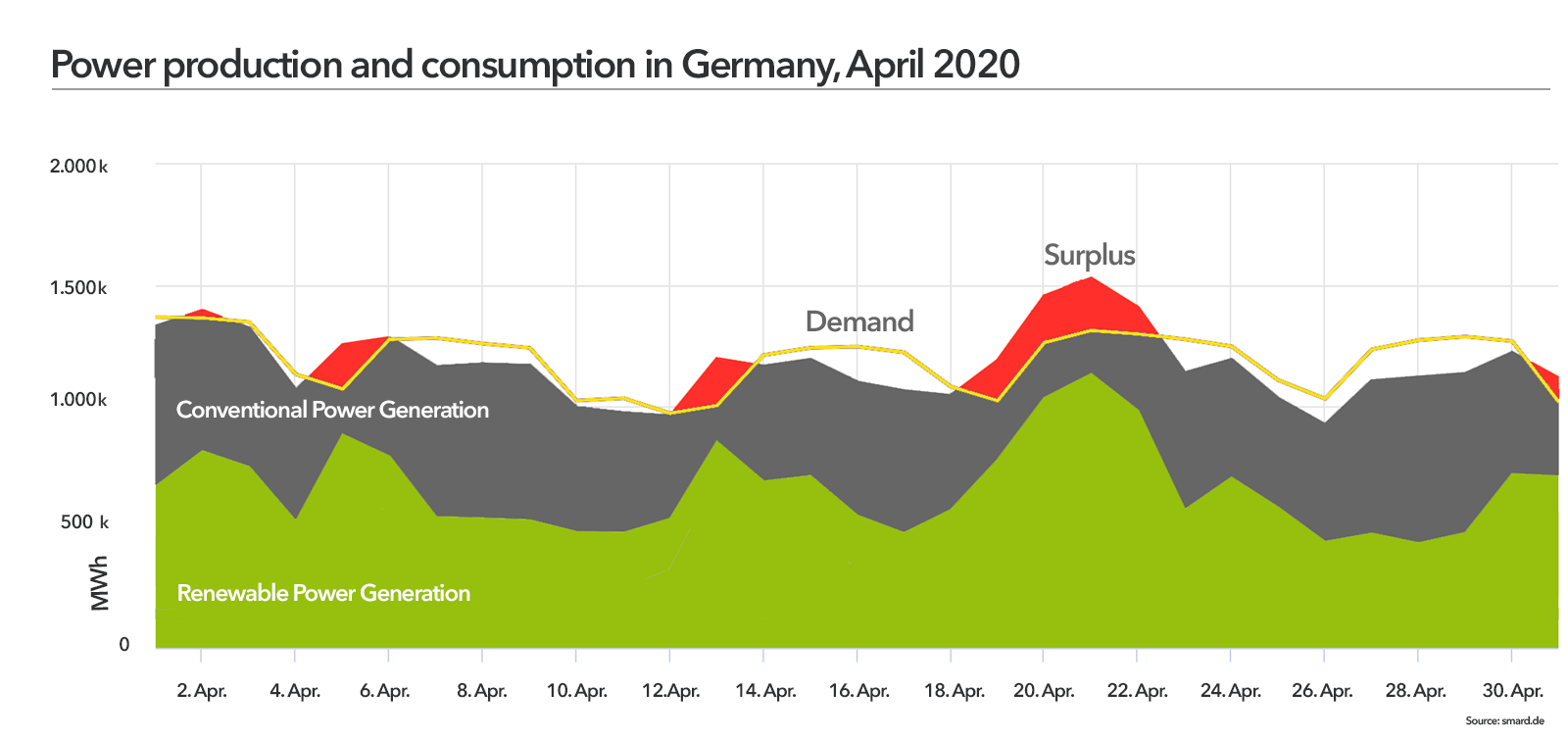

Meanwhile, the power generation plants continued to produce electricity as if nothing had happened. Largely automated or even operating autonomously, as many renewable plants do, they were in no need for human interventions. To maintain security of supply, the TSOs sent out remote orders to shut down power plants in a controlled manner but in an unprecedented quantity. However, these system-induced delays do not yet fully explain the negative electricity prices in April 2020.

Very Stable April Weather Drives Production Up and Prices Down

The weather around Easter was particularly fertile for renewable energy production in central Europe: very sunny, very windy, not a cloud in the sky - for weeks, Germany experienced an extremely sunny and dry April, of course mainly seen through the living room window for the public.

An unusual amount of electricity from wind and sun thus pushed many additional megawatts of electricity into the energy market, hitting very small power demand. On April 21, renewable sources met Germany’s electricity demand almost completely. However, the chart also shows that the actual electricity production in Germany overshot the demand with several hundred thousand megawatt hours.

Read more

Conclusion: No Fever - but Further Observation

Can we look at the electricity prices or the oil price as society’s fever curve? On a closer look, as we have taken in our article, the answer is more complicated than it would seem at first sight – quite a pity for economists, politicians, and journalists. However, the electricity price is based on so many different factors that a monocausal view (consumption is gone, prices conclusively go down) cannot provide a complete explanation.

In addition, both for the electricity and oil price, various taxes and charges on the kilowatt-hour or the liter cause a long delay for significant changes on electricity and fuel bills. Even in 2020, energy, regardless of its offspring, will not be free and remains precious. As a medium-term forecast, it is quite possible that the upcoming economic dry spell, which is very likely after the global shutdown, will keep energy prices from rising.

Apart from negative electricity prices, however, the corona crisis has not had any serious negative impact on the electricity market or the electricity system as a whole. The electricity system, not only in Europe, has so far proven resilient against the consequences of a global pandemic. This is not least due to the extraordinary efforts of transmission system operators and distribution system operators to ensure security of supply. Similarly, establishing and enforcing guidelines to ensure the reliable functioning of critical infrastructure have made a significant contribution to the current situation. If the price for this is only a few negative hours of electricity prices, we can survive this crisis quite well – at least from the perspective of the energy market.

More information and services