“California’s grid operator falls short during recent heat wave”

On Friday 14 Aug, an extremely hot and dry day in California and the west, California’s independent system operator (CAISO) had to resort to limited rolling blackouts that affected approximately 400,000 customers in California on Friday and the following Saturday 15 Aug.

Even though the extent of the rolling outages was limited and only lasted for a couple of hours, it nevertheless showed that the entire grid was under extreme stress and immediate action had to be taken to avoid a total collapse of the entire system. Below are excerpts from a recent interview with Dr. Fereidoon Sioshansi, president of Menlo Energy Economics, based in San Francisco, CA.

Q: Thanks for talking to us about the recent developments in California’s power grid. Can you briefly explain what exactly happened and why?

A: During a recent heat wave covering the entire western part of the US, California’s independent system operator (CAISO) had to resort to limited rolling blackouts on Friday 14 August. There was a similar episode on the following day Sat 15 Aug.

Q: How many households were affected by the rolling blackouts?

A: To preserve the grid from total collapse, CAISO ordered the state’s three biggest utilities – Pacific Gas & Electric Co (PG&E), Southern California Edison Co (SCE) and San Diego Gas and Electric Co (SDG&E) – to turn off power to more than 410,000 homes and businesses for about an hour at a time during the emergency. The ISO instituted a second, but shorter, rolling outage on Saturday evening that cut power to more than 200,000 customers. The utilities, however, informed their customers that it was not their fault but the fault of CAISO.

Q: Which actions did the grid operator take to alleviate the situation?

A: As often happens during such emergencies, by the time CAISO realized that it was running out of available capacity, there was no time to do much of anything other than to shed some load to preserve the reliability of the network.

Q: What is your take on the underlying reasons for the stress on the grid?

A: By the order of the governor, the episode is currently under investigation. We will know more what exactly went wrong, why and who is to blame. But based on what we know, a few natural gas fired plants that were expected to serve the peak load unexpectedly went off line and/or could not operate as planned, contributing to the shortages. Table below, from CAISO’s website, shows exactly how precarious the supply and demand situation was on the following Monday.

| Available resources to meet demand | 51,046 MW |

| Expected peak demand | 49,504 MW |

| Spare capacity | 1,542 MW; 3.1% of peak demand |

| All time CAISO peak | 50,270 MW on 25 July 2006 |

Source: Caiso

Q: What might other countries or regions learn from the incidents in the Californian grid?

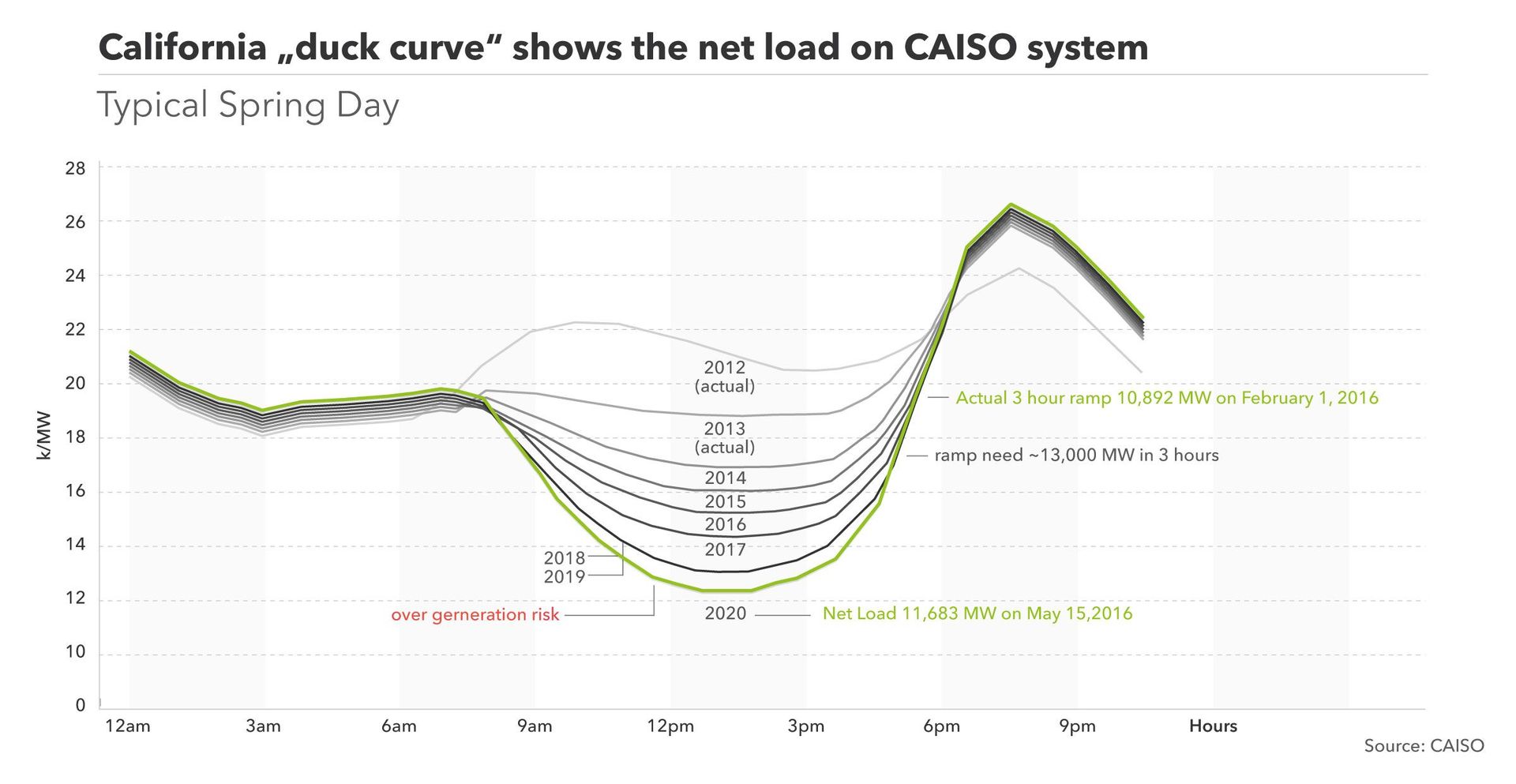

A: Clearly, every time there is an accident of this nature, there is a lot that everyone can learn from it, even if the circumstances on CAISO are different. While we currently do not know all the details the most important lesson for CAISO probably is that sun sets at the end of the day while the peak demand occurs a few hours later. Serving the load during this critical period, the neck of the California “duck curve” illustrated below, has been a challenge for CAISO ever since it publicized the existence of the “duck curve” in 2012.

California “duck curve” shows the net load on CAISO system

Normally, CAISO fills in the gap created by the disappearance of the solar energy by relying on natural gas fired peakers as well as imports from the neighboring states. But on this critical occasion, there was apparently a shortfall in the natural gas generation and the neighboring states did not have any excess power to sell because they were facing a similar heat wave themselves. CAISO is far too dependent on solar energy – which is not available after the sun set. It needs more wind, more geothermal, more hydro, more biomass and biogas, and far more storage. More natural gas fired plants are somewhat controversial in California since the state is pushing towards to 100% carbon free future by 2045. It also needs to develop and deliver demand flexibility – which can be greatly helped by having time-of-use (TOU) rates as well as dynamic pricing. Prices in the wholesale market spiked to $1,500/MWh while the great majority of customers remain on flat tariffs at much lower levels.

More to read

Q: Do you think the incidents will shape energy politics in California or even the US in the time to come?

A: The proponents of the California’s green agenda are keeping their fingers crossed that the light will stay on and CAISO will survive any further setbacks in the near future. If the lights go out again for any extended period, the naysayers will be able to blame the rise of renewable resources as the cause of the accident – which clearly was NOT the case. But it is natural for the critics to blame the variability of renewable generation rather than the unpreparedness of CAISO.

Q: What more can you tell us about the recent episode?

A: This link provides further details until the results of the inquiry are released.

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.

About the Interviewee

Fereidoon Sioshansi is President of Menlo Energy Economics, a consulting firm based in San Francisco, California, with over 35 years of experience in the electric power sector.

He advises domestic and international clients on strategies to respond to the rapid transformation of the electric power business including utilities, energy intensive industry, innovators, start-ups and companies engaged in electricity delivery supply chain, regulators and policy makers.

Dr. Sioshansi is the editor and publisher of EEnergy Informer, a monthly newsletter with international circulation, now in its 30th year of publication.

His professional experience includes working at Southern California Edison Co. (SCE), Electric Power Research Institute (EPRI), NERA, and Global Energy Decisions.

Since 2006, he has edited 13 books published by Academic Press including the following:

• Variable generation, flexible demand, forthcoming in 2021

• Behind & behind the meter: Digitalization, aggregation, optimization, monetization, 2020

• Consumer, prosumer, prosumager: How service innovations will disrupt the utility business model, 2019

• Innovation and Disruption at the Grid’s Edge, 2017

• Future of Utilities, Utilities of the Future, 2016

• Distributed Generation & its implications for the utility industry, 2014

More information and services